Education Insurance Policies in Kenya – Top 5 Lies to avoid

Every parent wants the best for their children. Hence, we tend to be emotional when it comes to choices on their learning. Education insurance policies use these emotions to profit from us. My goal is to help you make better choices.

Fear and greed are the main emotions that drive our investment choices. For example, education insurance policies in Kenya will sell you these emotions:

- What happens to your kids if you die?

- What happens if you lose your job?

- You will earn a big bonus in 10 years.

- The plan will earn you a million in 21 years.

- You will ‘eat’ their school fees.

Try and see which emotions are being sold above. Firstly, we need to understand how education insurance policies in Kenya work. Secondly, we need to know other ways to pay for education in Kenya. Finally, we need to protect against any risks.

How education plans work in Kenya

Education plans also known as Education insurance policies in Kenya are two items in one. That is:

- Insurance against death or disability.

- Saving plans

I have no problem with the life insurance part. However, you should buy it on its own. It is actually cheaper that way. You can then use the extra money saved to prepare for your kid’s school fees. A good place to start that is a low risk money market fund.

I have a problem with the saving part of the education insurance in Kenya. That is what costs you money. You pay extra fees for them to take your money and put it in their own unit trusts! It makes sense to invest directly and save on the fees.

Further, the returns are usually low. They barely cover for inflation despite years of saving. That means, you are actually losing! This is because your money in the future won’t be able to buy as much as today.

Education plans in Kenya are also not flexible. In an emergency, you would lose money if you withdraw before the set time. However, it can be good as it forces saving for those who don’t have the habit. Luckily, I will show you a better way to save without the forced feeling.

The above are the basics of most policies and plans. Obviously, people in sales will complicate it and try to sell you dreams or fear. Don’t be fooled! The harder it is the more likely it is a bad deal for you.

Education plans in Kenya

Below is a list of all the education plans in Kenya in 2022:

- Elimu Bora Education plan (Britam)

- Super E Education plan (Britam)

- Masomo Plus (Cooperative Bank)

- Educator plan (Liberty)

- Career Life Plus (Jubilee insurance)

- Elimisha Education plan (KCB and Liberty)

- Madison Uniplan

- Bima ya Karo (Madison)

- Lengo Education Saving plan (UAP Old Mutual)

- Elimika Education plan (UAP Old Mutual)

- FlexiEducator Insurance plan (Sanlam)

- Usomi Bora Education policy (ICEA Lion)

- CIC Academia Policy

- Msingi Poa Education Plan (Britam)

- Boresha Elimu Education Plan (Britam)

Best education insurance policy in Kenya

So you maybe wondering which is the best education insurance policy in Kenya out of the long list above. The answer is none. None is the best.

I asked members of my Telegram Group to share their insurance education policies in Kenya. These things are boring to read. Further, I think they make it hard to understand. That way, you just sign on the dotted line based on word of mouth.

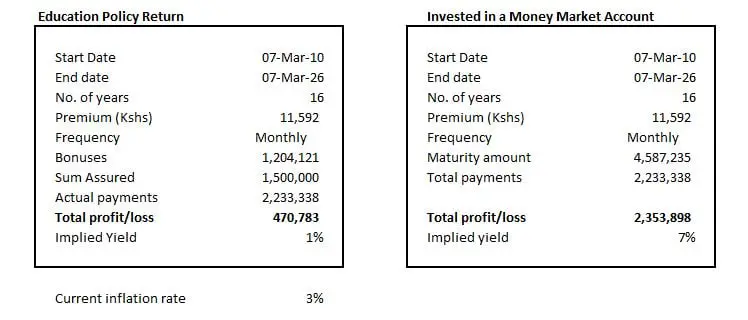

In this case, the bonus of Kes 300,000 every 4 years looks like a lot! Greed takes over when you dream of getting over 1M in 16 years. That is, until you do the math. The same amount invested monthly in a Money Market Fund would earn 5 times more profit!

Here is step by step guidance on how to join Sanlam Money Market Fund

Here is step by step guidance on how to join CIC Money Market Fund

Further, when you look at the return, it is below the current inflation rate. That means the money you will receive at the end, will buy less than what it can today! This article shows how to earn higher via other compounding machines.

Money Market Funds are one of the best compounding machines in Kenya. This is especially so for people who were considering investing with education insurance policies in Kenya. This is because MMFs are low risk investments therefore providing safety of the funds invested for your child’s education.

However, be careful when you choose a money market fund to avoid those that might put your investment at risk. I wrote about the factors to consider when choosing the best money market funds in Kenya here.

Here is the are the answers to frequently asked questions about money market funds in Kenya.

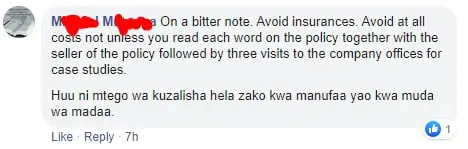

What people have to say about education insurance policies in Kenya

The next step was to visit Facebook and see what people had to say. I have to admit, Kenyans are a funny bunch. Even when things are bad, they still find a reason to laugh!

My key takeaways are:

- Kenyans are not happy with insurance companies

- The returns from education plans in Kenya do not live up to people’s expectations

- It is hard to get your money back before the agreed time. Most end up with a loss or don’t like the process.

Here is a video summary of this article:

Don’t buy the emotion – how to deal with fear and greed

Before I leave, let me deal with some of the emotions listed earlier. I will also show the emotion at play in each of them:

- What happens to your kids if you die? Fear – Buy life insurance only to take care of this! It is cheaper. It takes care of your family in the event of death or disability. Please check first at your workplace. You don’t want to buy yet it is given at work.

- What happens if you lose your job? Fear – Ensure you have 3 – 6 months of expenses saved in an emergency fund. The best place to do this is in a Money Market Fund. You can also buy insurance against job loss.

- You will earn a big bonus in 10 years. Greed – No you won’t! Do the math. Learn about the power of compounding.

- The plan will earn you a million in 21 years. Greed – See point above 🙂

- You will ‘eat’ their school fees. Fear – Agents like to sell the forced savings as a good thing. Why not set up a monthly standing order? Why not get someone to hold you accountable? Then open a joint account with them. Ask them to not allow you to ‘eat’ the school fees. Ask them to only allow you to get the money if ‘x’ or ‘y’ happens. That way, you are able to have your cake and eat it too!

The trick for a savvy person is to separate the parts of an education insurance policy:

- Investment – rather than using the policy to invest over 10 years or whatever is the policy period, take those contributions into a low risk money market fund (MMF) offered by the same insurance company. You will end up with more money at the end of the period than someone who contributed into the policy. And the best thing is, incase of anything, you can withdraw your money from the MMF WITHOUT losing your hard earned savings! No penalties for early withdrawal. You keep your capital and interest!

- Insurance – rather than buying into an education insurance policy for protection against death or disability etc. Just go and buy that specific insurance cover from the insurance company. It is cheaper, less complicated and offers the cover you are looking for.

Most people don’t take the time to understand education insurance policies, because if they did no one would ever choose them and the products would cease to exist as they don’t make sense in comparison to the options highlighted above. So don’t be in a hurry to sign any documents until you fully understand what you are getting yourself into!

Hope that helps you further! Go forth. You are now as wise as that old owl! Educate others as well 🙂

Other Valuable Guides

Here are links to other valuable content on this blog:

- The Ultimate Guide to PayPal in Kenya

- Here is the link to the Free Personal Finance Lessons for Kenyans. The first 10 free lessons are ready for your learning!

- Below are some short and sweet personal finance and investing lessons. Watch. Learn. Enjoy. Share.

Future topics in this series

I want to do this right. Hence, I have broken down the article into mini topics. This also helps as it takes a lot of time to research and write a detailed piece.

You can look forward to the following topics:

- The lies agents sell to customers and how to beat them at their game.

- Why you should read the policy document in detail.

- Why 3 is the number to watch out for when it comes to education insurance policies in Kenya

- How education plans in Kenya lose you money in the future.

- Other Kenyans’ thoughts on better ways to pay for school fees.

- My thoughts on the best way to prepare for school fees. Copy what I am doing or plan to do for my son.

Let me know in the comment section:

- if I have missed something that you would want me to write about.

- your thoughts on the article so far.

- your own experiences with education plans in Kenya.

It’s oddly difficult to get such basic financial info in this country, without having to pay for it.

Thank you for this.

Imagine, I was about to sign the policy documents. Changed my mind. Thanks for the great insights. Maybe I should try the MMFs, any recommendations kindly?

Phew! Good for you to think to research first before signing! In terms of MMF, my recommendations are the below:

https://nashthuo.com/sanlam-money-market-fund/

https://nashthuo.com/cic-money-market-fund/

I should have read this 8 years ago now am losing 80% of my hard earned money

Sorry about that…such is life…we live and we learn. Share the article so someone else doesn’t have to make the same mistake

I had two policies with them for 11 years and at the end i received less then what i had contributed. I lost about two hundred and fifty thousand.

Staff is not updating you about your payment schedule, statement etc. At the end they deducted money saying service charges for maintaining your account. Not a single shilling was given in the form of interest. Its like fooling people.

It is unfortunate that this happened to you. Hope you can share your newfound knowledge with others so they can avoid walking down that path

If only I had this knowledge before committing to an Educ Policy that im now stuck with. I however intend to stick with it for the next 3 years which is the minimum period if i dont want to lose my entire contribution, then cash out (at a loss, but hey, it makes little sense knowing what i know now) then reinvest in MMFs or other compound interest earning option.

Yes that approach makes sense to be honest…rather see it through until the point that you won’t you don’t lose your principal when you exit and then when you can at least access your principal without a penalty, you can move to an investment that makes sense!

thank you for this information.

You are welcome! Share with a friend, colleague or family member who would benefit from the information 🙂

This is an eye opener . Now I know better though after the fact

Well researched. Bumped on this one while doing my research on education policy. I had reservations about it but couldn’t put my finger on it but this article was well articulated.

Wish I had come across this article in 20-freakin-16! All that stuff about fear is so on point. And the fine print

I have just read your article and felt so wasted because everything you said is true ,I got an education policy with ICEA …maturing next year when my kid does std 8 and after looking at what am getting in a staggering 4 yes ,I feel like was bewitched ,now am in the 40 category I think I would make better judgement in terms of MMF …am interested in CIC …do I need to go to the company or ?

Such a good read as I have my breakfast! Thanks for the information Nash. Keep it up!

This is wisdom, thank you!!

You are welcome Anne! Bookmark the article because I am not yet done with my insights on the topic.

Knowledge is power. Thank you for the information. I must also forward this to my friends.

Yeah! I think every family should read it. Forward to as many as we can so we can educate the masses

I fell in their trap,am one year old in KENNIDIA….ill cancel the deal… thank you for the information.