Personal Finance Kenya content is rarely tailored to our market. It feels more like a repetition of American content. This frustrates Kenyans when it doesn’t work.

Even worse, there are a lot of personal finance courses in Kenya charging a lot of money for basic information! You should have been taught this in school and not pay for it as an adult! This is my small way to correct this and give back to my fellow Kenyans.

PS: The principles herein can be applied anywhere in the world. Some aspects will be unique for a Kenyan or someone in Africa. Different part of the world. Different challenges. Different opportunities. I will refer to Kenya though as it’s home.

Personal Finance Kenya: Lesson 0

Look forward to over 10 lessons on how to manage your money in Kenya. Yes that’s right! These are comprehensive personal finance lessons at no cost to you!

Practical content that works in Kenya not content repeated from American books and media. Forget 401Ks and Roth IRAs. What about NSSF, chamas or Kenya NSE? I waited until I achieved financial freedom so as to start these lessons. Therefore, I can say these insights work in Kenya!

You’ll get access to templates I created through my financial freedom journey. So you won’t be starting from scratch and will be using something proven to work here in Kenya! So you might be asking. Why would someone be willing to give all that for free?

Reason for the free Personal Finance Kenya lessons

Hope the video explained why I chose to share these free lessons. That it also shows you how a small act of kindness can not only come back to help you but also those close to you. How it can inspire you to do something not only for yourself but society as a whole.

I’m hoping these lessons will save you valuable time so you don’t have to figure this out all by yourself. Neither, will you need to pay for the basics of personal financial management in Kenya. Take the money you would have paid and start your investment journey with a basic money market fund.

Since, you would have spent it either way, leave it to compound and then talk to me after 10+ years! Oh the things you’ll do with your pot of gold…

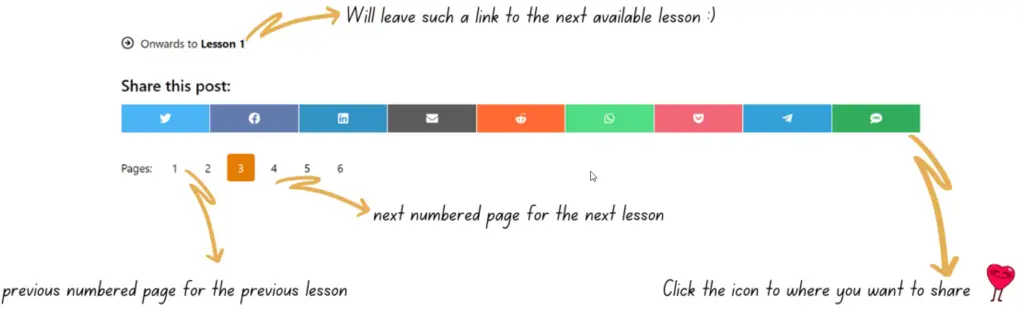

How to navigate the personal finance course

The lessons are crafted to offer more insights as you go deeper. Each next numbered page is designed to amaze you more than the last one! Think of each new page of the lessons as the guidance you need for the next step in your journey to financial freedom.

I will tag along to cheer you on and provide guidance. Leave a comment if you have any questions or feedback. I promise to answer every comment. Excited to see you in the next lesson. But first chew on some disclaimers.

Disclaimer on the Personal Finance Kenya Lessons

The lessons herein are based on my experiences. There is no certification behind them! That’s their value! It’s not something learnt through a lecture or certification.

It was learnt the hard way! Through trial and error. Through trial and success. I am sharing what has worked for me here in the 254. Therefore, this Personal Finance Kenya lessons are for a broad audience. They are not tailored to you or your circumstances. Most bloggers will tell you at this point to consult with a professional (which you should). I am not most bloggers though.

I will do one better. No person or professional can tell you what is best for you. You know what is best for you. You can and should consult with a professional but make sure you make and own the decision on what to do for your finances. That’s why it is called Personal Finance. Apologies, I was wrong. Mums. Mums know best. So it is you and or your mum. No one else. Unless… your mum is a professional. In which case double great for you! And oh… I am no slouch either:

Enough on career and qualifications. That’s what my LinkedIn profile is for! Just wanted to say, I may not be a mum but I know a thing or two. That said. Read the lessons. Think about them. Use the information to make the best decision for your finances. Then #PayItForward

Now that you have had your delicious course of disclaimers, we can move on!

Getting the best out of the Personal Finance Kenya Lessons

See, we can blame accounting!

Subscribers of the are notified about new video lessons!

Kenyan Telegram Channels

Subscribers of the Personal Finance Lessons Telegram Channel are notified on new content and get links to the free templates!

Otherwise, you can interact with the rest of the nasthuo.com community in the Telegram Group.

I believe in paying it forward. So, help the next person by sharing this article. We need to walk this financial freedom journey with our friends and family.

Personal Finance Kenya: Lesson 1

Welcome! You are about to experience a personal finance masterclass Kenya specific and at no cost to you!

One of the most powerful things you can do for your money, is to create a personal net worth tracker. You will build your own tracker in the next few lessons of this personal finance course for Kenyans!

Having achieved financial freedom, I can confidently say this specific template is proven to work here in Kenya!

It has also taken over 9 years to perfect! This lesson will focus on the Liquidity section of the net worth tracker. So it’s all about getting your Kenya Shillings right!

Here are key takeaways from the lesson:

How to set up banks in Kenya

My bank account setup in Kenya

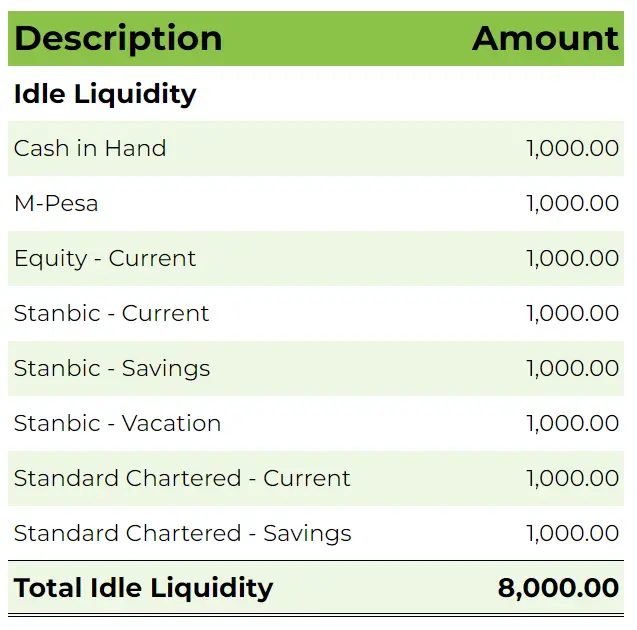

Below is how I’ve set up my money:

*For illustration only – not actual amounts

I call this the “Idle liquidity” section of my net worth tracker. This is because your money is not working for you if it is here.

- How many banks do you have?

- What’s your best bank in Kenya? Why?

Let me know in the comment section.

Younger Nash liked to open a lot of bank accounts for various goals. He got wiser as he learnt more about managing money in Kenya. The above is actually an old set up before I learnt I can have my cake and eat it too.

That I can be liquid while having my money working hard for me. That is the next topic. #PayitForward

Personal Finance Kenya: Lesson 2 – Introduction

Hope by now you have found value in the lessons.

Trust by the end, you will save money by not attending an expensive personal finance academy.

You will also save time spent crawling through finance blogs in Kenya.

This lesson digs into the Liquidity section of the net worth tracker. It’s about setting up a money system that works for you in Kenya!

The power of cash flowing liquidity

I have become financially wise mostly through trial and error and trial and success. One of the most powerful discoveries I made in my journey to financial freedom in Kenya is what I like to call “Cash flowing liquidity”.

I have not heard anyone talk about it in the way I will. So I am actually claiming it as my original insight! I honestly stumbled across it and it has done wonders in fast tracking my path to financial independence in Kenya!

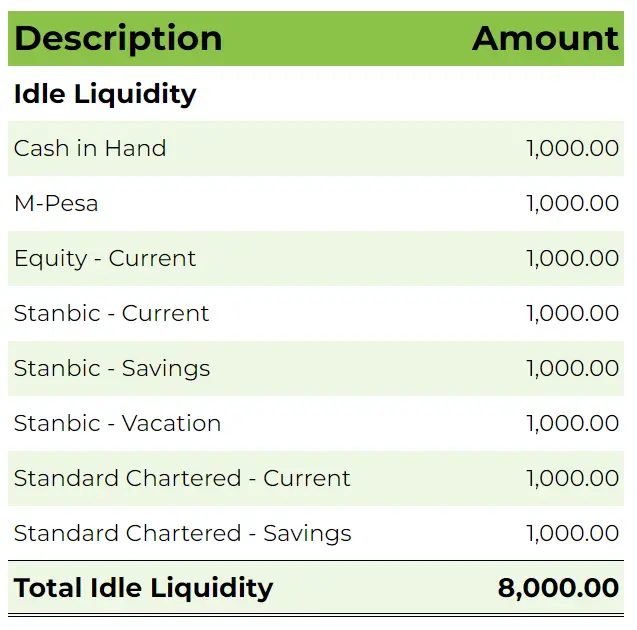

Once, it clicked in my mind, I started enhancing my approach to money in Kenya. Here is what my Kenyan bank account setup looked like before:

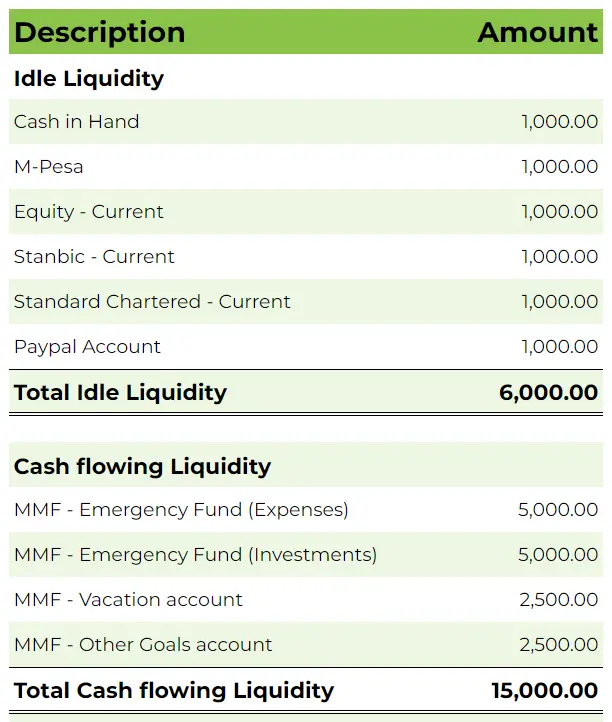

As I said, there were many experiments done to optimize the returns without sacrificing liquidity and this is how it looks now:

*For illustration – not actual amounts

Cash flowing liquidity is a big part of my Jaza Shilingi system to growing your wealth in Kenya. The Nash Thuo Jaza Shilingi system. I like the ring of that!

If Kenyatta and Moi can name all the roads, schools, hospitals and goats in Kenya after them. I can also name a system I perfected over the last 9 years!

So let’s dig deeper into each item in the liquidity section of your net worth tracker. The items are in order of liquidity.

Cash in Hand

This is most liquid section. It’s basically the coins and notes you carry in your pockets. I try to carry minimal cash.

Carrying cash has so many cons:

The more you stay in cash, the more likely inflation will erode it.

M-Pesa

I try to have as little as possible in my M-Pesa account. This is especially so in the age of instant Bank to M-Pesa transfers.

People rarely talk about it but M-Pesa is an expensive way to transact! Convenient but expensive. Hope this changes soon. A solid and innovative company though.

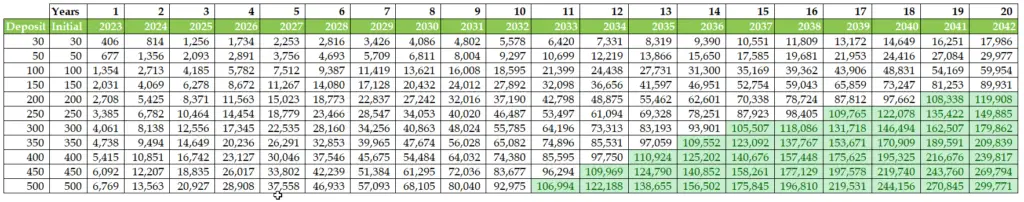

I did the math. This is how MPESA charges avoided and invested in say the Sanlam Money Market Fund would grow!

M-Pesa has similar cons to its sister cash (though better than carrying hard cash):

Similarly, its purchasing power is eroded by inflation if not invested.

Learn about the New MPESA charges for sending or receiving money via phone, ATM or MPESA agent.

The guide includes a curated list of transactions that are FREE via MPESA!

The insights from the other items in the nashthuo Jaza Shilingi system were so great they earned the right to be separate lessons!

Exciting stuff ahead!

Personal Finance Kenya: Lesson 2 – Banks in Kenya

When it comes to personal finance management in Kenya, where you bank matters a lot. That’s why you should carefully choose your bank in Kenya.

Sharing the same bank with the people or entities that you frequently transact with, not only saves you transfer charges but also ensures faster transactions!

As noted in the previous section, transaction costs do add up! You will note I made some changes to the earlier lesson’s setup.

Current accounts

My accounts with all the 3 banks are zero fee. You don’t need 3 accounts though! Follow the process in the previous lesson on which bank account(s) to open. Read the how to choose a bank in Kenya article for more guidance. The goal is to lower banking costs while getting faster transactions.

Excellence is when you automate your transactions. That means your recurring expenses and investments are done automatically. There is no need for discipline as you just need to set up the system once. That’s how you wake up one day and you have achieved financial freedom easily!

Saving accounts

Once you learn about money market funds, you wonder why anyone would open a savings or fixed deposit account!

Here are a few things to consider before opening a Fixed deposit account in Kenya:

Savings accounts give notoriously low interest rates in Kenya. The average for all the banks is between 2% and 4%. If your saving account restricts how many withdrawals you can make in a month, then one would rather maintain funds in a zero fee current account.

If your savings account has unlimited withdrawals, my rule of thumb is to save at least one month’s expenses in it. In such a case, the account should be with the bank you pay the most expenses out of. This helps when you have standing orders and provides a ready buffer for your expenses.

The rest of your money should be in a money market fund. You will get higher returns without sacrificing liquidity. That’s because you can get your money within a maximum of 3 working days. You receive it even faster if you and the MMF share the same bank. For example:

- A CIC Money Market Fund and banking with Cooperative; or

- A Sanlam Money Market Fund and banking with Stanbic.

The next lesson shows how you could have made a 100% return passively! Then, it prepares you to win in the future!

Personal Finance Kenya: Lesson 2 – PayPal in Kenya

PayPal is for those who earn money in Kenya online? True. You will need PayPal or a similar service. However, PayPal in Kenya, is the most common mode of payment. Few personal finance coaches in Kenya though discuss its role in your personal finance management. Let’s fix that.

Let’s unpack this graph!

Not sure about you but my mind was blown when I figured this out! I couldn’t believe how obvious and simple it was and no one had told me about it! As I said, lots of experiments and realizations in the 9 years prior to this personal finance course for Kenyans!

So back to the graph.

I always thought the rate was around 70 bob when I was young. The surprise on me when I googled and the chart shows at some point it was as low as Kenya Shillings (Kes) 58 for $1! Granted, this was back in 2008 which was a sad time for our great nation. The crazy part though. The pull your hair out part is, I used to write online articles back then as a way to make money. The site (iWriter) would pay, in USD, to my PayPal account in Kenya.

I was crazy young, dare I say crazy handsome and crazy stupid when it came to money! I can’t even remember how I used the money! I have tried for the last 5 minutes. Nothing. But it was probably something stupid. Back then there was no Nash Thuo to teach me personal finance or where to invest my money in Kenya. But young Nash had to walk so you reading this can run!

So back to the chart.

I wager I made about $500 over my article writing career. That is about 29,265 in 2008 Kenya shillings. Looking back, the pay wasn’t enough for the hours spent. I didn’t know any better though. I will discuss how to make money online in Kenya another day.

Back to the chart.

If I had kept the $500 in my PayPal account and did nothing. No fancy investments in stocks. No Treasury bonds. No Saccos. Nada. If I was lazy and just left it, then the $500 would be 58,820 in 2022 Kenya Shillings!

That is a 100.99% return!

Again. No fancy spreadsheets. No secret tips. Just simple and obvious. If there is one thing I have learnt is that the best form of investing is one that is simple. The moment someone sells complexity, I walk away. Not worth my peace of mind and probably will mean losing some of my hard earned money in the future!

Unfortunately, our eyes seem blind to simple but profitable opportunities because for some reason we think things have to be hard. Otherwise, everyone would make it. Right? Wrong, it’s often the simple that is ignored or worse it remains hidden in plain sight! What is your simple way to earn money or invest?

Please let me know in the comments section. Open my eyes to the simple. The student can also be the teacher! Share it.

We should cry together especially if you had more than $500 back in 2008. But as I learnt from one of my favorite books of all time. The . No use in spending time on what has happened to you. Take the lesson and move forward stronger and wiser.

Key Takeaways

Here are the lessons you should take away from this section:

Warning

Find a way to earn in dollars. I never said to convert your Kshs to USD! That’s a recipe for losses. You’d lose via exchange fees. Also, the Kshs may strengthen after thus more losses. The goal is to protect or enhance your purchasing power. It’s not to be greedy and game the market. You are not a forex trader. Find a way to earn in US Dollars and move on.

Now let’s dig deeper into the cash flowing liquidity section of the net worth tracker. What is coming up is an integral part of growing your wealth in Kenya.

Honestly I just want to say thank you.I have learnt Soo much in just a few hours.i can’t believe I read through all of this and was able to understand mostly because of how you’ve simplified it and the added humor.Now I can say am on the path to financial freedom.

Thank you so much for the lesson..have grown a step

You are welcome! Share with the others so they also learn 🙂

Informative read….i like it. I came from Reddit

Awesome to hear! Happy to know Reddit peeps are learning as well 🙂