Sanlam Money Market Fund is known as the best money market fund in Kenya when it comes to customer service.

I should know as I’ve personally invested my money with them!

Sanlam Money Market Fund Fact Sheet

Here is the latest Sanlam Money Market Fund (Kenya) fact sheet:

| Attribute | Information |

|---|---|

| Started on | November 2014 |

| Risk profile | Low/conservative |

| Initial fee | Nil |

| Fees | 1.2% (annual) |

| Effective rate | 10.2% (annual – net of fees) |

| Initial deposit | Kshs 2,500 (minimum) |

| Top-up | Kshs 1,000 (minimum) |

| Fund manager | Sanlam Investments East Africa Limited |

| Trustee | Stanbic Bank Kenya Limited (Corporate Trustee) |

| Custodian | Stanbic Bank Kenya Limited (Tier 1 Bank) |

| Auditor | PwC (Big 4 audit firm) |

| Establishment | Related to Sanlam listed in the JSE (SA) |

| Access | Web portal & mobile app |

| Distribution | Interest earned daily, compounded monthly |

How to join Sanlam Money Market Fund

Here is step by step guidance on how to join Sanlam Money Market Fund.

The process if fully online. No need to meet an agent physically or go to any offices.

This saves you time and keeps you safe.

Also makes it possible to open a Sanlam MMF account even when out of the country.

Total Time: 10 minutes

Download the applicable form

Complete the applicable Sanlam Money Market Fund application form.

You can also access all the latest Sanlam forms in this folder. See also detailed section below.

Append signature(s)

Remember to sign all sections of the applicable form that require a signature.

For your convenience, these sections are marked with two red stars**

Complete the residential details section

The Land Registration number is optional.

If you don’t have it, just ensure you indicate the name of the office block/apartment/estate and the nearest road/town.

Use your Kenyan residential details.

If you are overseas, use your address back home or your parent’s.

Any non-Kenyan residential details need to be accompanied by a certified utility bill showing your name and residential address on it.

Complete the risk assessment section

The results of the assessment don’t affect your decision. e.g. you can still invest in a money market fund even if it suggests an equity fund.

Include KYC documentation

Make sure to read the section below on the KYC requirements for each type of application form. PDF format is preferred.

Submit the completed forms and KYC documents

If you can’t get access to a scanner or haven’t completed the forms electronically, then clear photos are also acceptable.

Send the documents to nashthuo@gmail.com

Even if you drop them off at the Fund’s offices, I recommend you inform me on email so I can help fast track the account creation.

Expect your Sanlam unit trust account to be created within a day of submitting the duly completed forms and KYC documents!

Account creation

I will then send an intro email for the account creation and copy you in.

The email will also include a free Sanlam Money Market Beginners Guide to help in your investment journey!

Please note that a minimum of Kes 2,500 or above will be required for Sanlam to finalize the account opening process.

Proof of payment can be any of the below depending on the method used to send the initial investment:

– M-pesa transaction reference number and time sent; or

– A screenshot or PDF of the bank transfer; or

– A scanned copy of the cash deposit slip; or

– Signed physical cheque.

See the Sanlam money market fund M-pesa and Bank details in the section below.

Your member number will be sent to the registered contacts filled in the form (email and SMS).

The message may take a day due to the volume of new accounts created.

However, if there are any significant delays let me know so I can push for you as well as check it in the system.

Access your free PDF wealth compounding report

Once your account has been mapped under my financial advisor code 04102, use this form to generate your free customized PDF wealth compounding report

The report shows you:

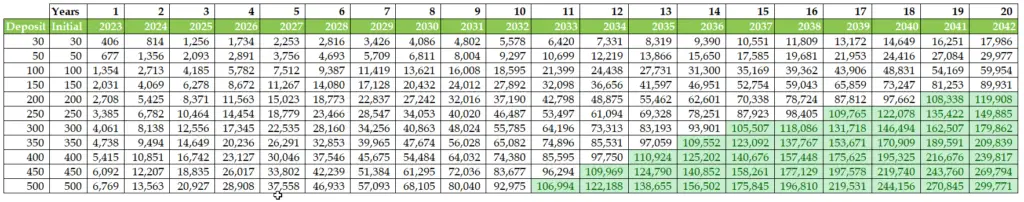

– How an initial deposit of x with monthly deposits of y invested in the Sanlam Money Market Fund will grow over a 15 year period.

– When your money will grow to ABOVE your targeted amount.

– When the monthly passive income earned from Sanlam MMF will exceed your monthly expenses i.e. when you achieve financial freedom.

– Run a scenario analysis of how quicker you’ll reach the targeted amount and monthly passive income if you were to increase your deposits by z amount.

Supply:

- Sanlam Money Market Fund Application Form

Tools:

- PDF Editor

- Nash MMF Bot

Materials: Sanlam Money Market Fund Application Form, KYC Documents

Sanlam Money Market Fund application forms

Sanlam KYC Requirements

- The following Know Your Client (KYC) documentation is required to join Sanlam Money Market Fund.

- For further guidance, click on the plus sign (+) of the applicable pane below.

Notes on the KYC requirements

- Make sure to read the below important points on the KYC documents before submitting them.

- Click on the plus sign (+) in each of the panes below for further guidance.

You can also get the forms by sending me a chat via this or Telegram link.

Sanlam M-Pesa and Bank details

- Initial deposit – Kshs 2,500 or higher.

- Top up – Kshs 1,000 or higher.

- Click on the plus sign (+) of the relevant pane for more details.

Learn about the New MPESA charges for sending or receiving money via phone, ATM or MPESA agent.

The guide includes a curated list of transactions that are FREE via MPESA!

How to deposit into Sanlam MMF via Stanbic Paybill

This section is not relevant for those with Stanbic accounts. This is because transfers will be free and instant as you share the same bank with the Sanlam Money Market Fund.

However, for those with other banks and want to deposit directly to Sanlam MMF’s Stanbic account (compare the M-Pesa charges, for this method and the one above and choose the most optimal):

- Go to the M-PESA menu and select Lipa na M-Pesa

- Then, Pay Bill option and enter paybill number 600100

- Then, enter account number 0100003738118

- Add amount and then the M-Pesa PIN

- You will receive a confirmation SMS from M-Pesa and from Stanbic Bank

- Forward the two messages above to clientservice@sanlameastafrica.com

- Remember to include your member number in the email above. This ensures quick allocation of the deposit to your Sanlam MMF account.

Please note, unlike when you use the Sanlam Money Market Fund’s paybill (888111), this method doesn’t allow you to input your member number.

Therefore it is VERY IMPORTANT to share the proof of deposit as per the guidance above.

The method used to be FREE but in 2023 now it incurs charges.

Sanlam Money Market Fund Video Guides

The Money Market Funds Kenya Bot has an in-built Sanlam Money Market Fund calculator which also shows the latest Sanlam Money Market Fund interest rate as of June 2023.

You can also find the latest Sanlam Money Market Fund interest rates for FY 2023/2024 in the section below.

Finally, you can watch this short tutorial on how to fill money market forms without printing or scanning!

Subscribe to the YouTube Channel for more video tutorials.

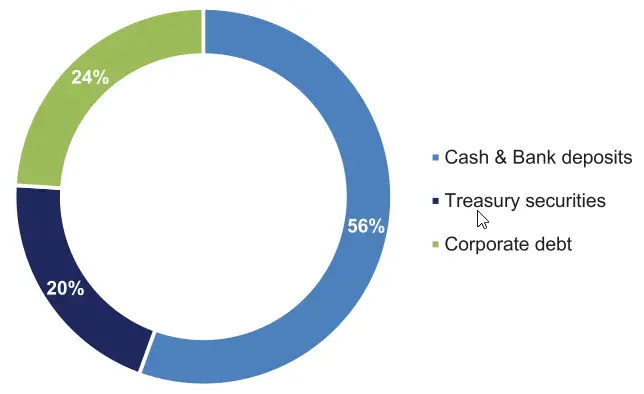

Sanlam Money Market Fund interest rates

- Interest rates go up or down based on the performance of the underlying investments.

- See FAQ section below which shows the assets which Sanlam money market fund invests in.

- Click on the plus sign (+) in each of the panes below for more details.

- First pane is about the daily yield.

- The second one has details on the effective annual yield.

Insider tips for your Sanlam MMF

- Here are the top 7 tips to make the best out of your investment with the Sanlam Money Market Fund.

- Click on the plus sign (+) in each of the panes below for more details.

Why invest with Sanlam Money Market Fund

- Here are the top reasons to join Sanlam Money Market Fund.

- Click on the plus sign (+) in each of the panes below for more details.

Frequently Asked Questions about Sanlam MMF

If you don’t find an answer in the FAQ section below, feel free to contact me or leave a comment.

I will answer it and update the FAQ section for future readers 🙂

- Click on the plus sign (+) in each of the panes below for more details.

Other Valuable Guides

Here are links to other valuable content on this blog:

- Complete step by step guide to PayPal in Kenya

- Here is the link to the Free Personal Finance Lessons for Kenyans. The first 10 free lessons are ready for your learning!

- The Comprehensive Guide on How to Earn Money in Kenya

- Easily get your TSC payslip online

- Below are some short and sweet personal finance and investing lessons. Watch. Learn. Enjoy. Share.

Useful Links

If you want to learn more about MMFs…

- Here are the benefits of money market funds in Kenya and why you need one.

- Here is a detailed guide on Money Market Funds in Kenya and how they work.

- Here are answers to frequently asked questions about MMFs in Kenya.

- If you want to diversify, CIC Money Market Fund is a great option for a second account.

Join the Tribe!

Get notified when new posts are published as well as access exclusive content in the Telegram Personal Finance Lessons Channel.

The Telegram Personal Finance Group is the tribe you have been looking for!

Subscribe to my newsletter for similar but exclusive guides tailored to Kenya!

Hope you found this article helpful and got some valuable insights.

Feel free to share it with your family, colleagues or friends who would be interested in a Sanlam Money Market Fund account.

Thanks for this insightful piece. Sadly the unit trust application does not work. I usually use the online portal

Agreed! I also use the online portal and not the app. Thanks for the feedback and sharing your thoughts

You are providing a really good information service to the general public for free! This is appreciated and shall be shared in most of my platforms.

Yes the best thing you can do is share the articles to your platforms so as many people as possible can benefit from the free content!

This was very insightful Nash. I am certainly very interested.

Thanks for the great feedback. You can reach out to me and will help you open your Sanlam Money Market Fund account within a day of receiving your filled forms and the required documents (as per the last page of the form)

Incase of any questions you can contact me via my email or WhatsApp number below:

nashthuo@gmail.com

+254 724 82 32 66