Introduction to CIC Money Market Fund

CIC Money Market Fund

CIC Money Market Fund is a type of a unit trust in Kenya that invests in low-risk securities, providing its investors with consistent returns and liquidity. It offers easy accessibility, professional fund management and tax benefits (interest taxed at preferable 15% withholding tax rate).

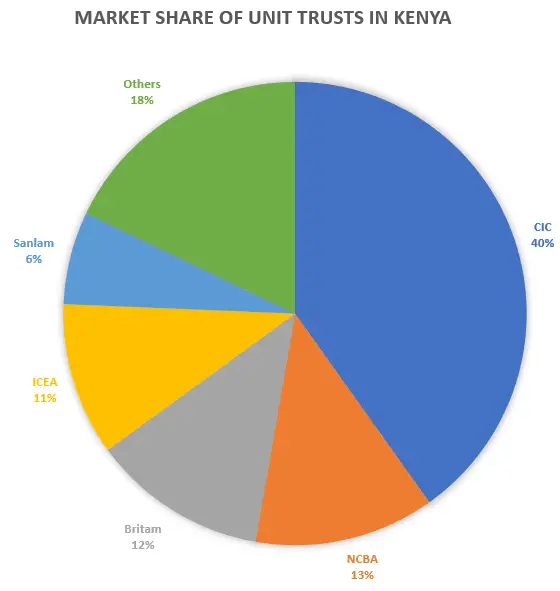

CIC Money Market Fund is one of the most popular money market funds in Kenya.

This is evident as its the largest money market fund in Kenya by Assets under Management (AUM).

CIC Money Market Fund reviews in Kenyan social media and Google are off the charts.

In fact, based on the latest report by the Capital Markets Authority of Kenya, CIC Asset Management Limited had a total market share of 38.05% of the Kenyan unit trust market.

CIC Money Market Fund Fact Sheet

CIC Money Market Fund Fact Sheet

Here is a table summary of the CIC Money Market Fund Fact Sheet

URL: https://nashthuo.com/cic-money-market-fund/

| Attribute | Information |

|---|---|

| Establishment | Largest MMF in Kenya |

| Online Application – No forms! | |

| Ease of Access | Web portal & Mobile app |

| Distribution | Daily interest, credited monthly |

| Effective Annual Yield | 9.6% (net of management fee) |

| Annual Management Fee | 2% |

| Minimum Initial Investment | Kshs 5,000 |

| Minimum Additional Investment | Kshs 1,000 |

| Initial Fee | Nil |

| Risk Profile | Low |

| Launch Date | June 2011 |

| Trustee | KCB (Tier 1 Bank) |

| Auditor | PwC (Big 4 audit firm) |

| Custodian | Co-operative Bank (Tier 1) |

| Fund Manager | CIC Asset Management Ltd |

How to join CIC Money Market Fund

Here is a step by step guide on how to join CIC Money Market Fund.

No need to meet an agent or go to any offices (Process is fully online to save time and keep you safe).

Thus, you can get started with CIC MMF even when out of Kenya.

Total Time: 15 minutes

Download the applicable form(s)

Fill in the applicable CIC Money Market Fund application form as shared below.

Append signatures

The sections of the form requiring a signature are marked with two red stars**

Fill in the residential details

Add your Kenya residential details e.g. name of the office, apartment or estate and the nearest road or town. The Land Registration number is optional if don’t have one.

Read this article for the Nairobi postal code and the rest of the Kenya postal codes.

If abroad, use your parent’s or own Kenya residential details. Otherwise, provide a certified foreign utility bill showing your name and residential details on it.

Complete the risk assessment

Complete the risk assessment to calculate your risk profile. You can override the results of the assessment if need be.

For example, you can invest in a money market fund even if it suggests the CIC Equity Fund and so on.

Include KYC documentation

See section below on the Know Your Client (KYC) documents needed for each type of application form.

Send the completed forms & KYC documents

Send the completed application forms and KYC documents to nashthuo@gmail.com

Scanned copies or clear photos are also accepted.

Expect your CIC unit trust account to be created within a day of submitting the above!

Account creation

I will then send an email for the account creation and copy you in.

The email will also include a free CIC Beginners Guide to help in your investment journey!

Do not send any money to CIC until you have been allocated a member number.

This is because your member number needs to be included as a reference any time funds are deposited into the CIC Money Market Fund.

Your member number will be sent to the registered contacts filled in the form (email and SMS).

The message may take a day due to the volume of new accounts created.

However, if there are any significant delays let me know so I can push for you as well as check it in the system.

Get exclusive benefits

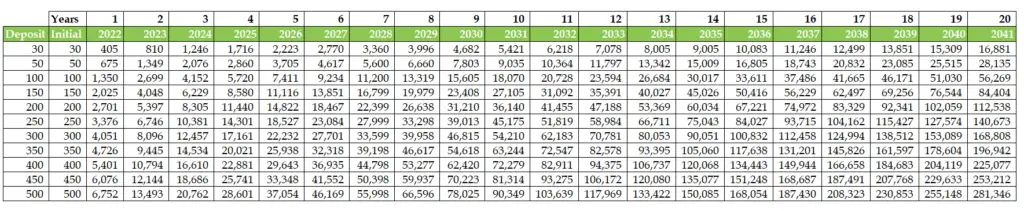

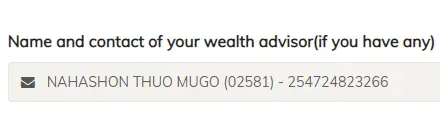

Once your account has been mapped under my financial advisor code 02581, use this form to generate your free customized PDF wealth compounding report

Supply:

- CIC Money Market Fund Application Forms

Tools:

- PDF Editor

Materials: KYC Documentation

Summary: How to Invest in CIC Money Market Fund

- Open an account with CIC Money Market Fund.

- Complete the required documentation.

- Deposit funds into your account.

- Choose your investment amount and duration.

- Monitor your investment and enjoy the benefits of consistent returns.

CIC Money Market Fund application forms

Please note you will have to request access to Google Drive Folder. The folder has the signed forms and member only guides.

I normally grant access to these exclusive folders within 3 hours from when access is requested.

How to get the CIC Money Market Fund Forms via WhatsApp or Telegram

- Chat with me via this or this Telegram link.

- Save my contact as Nash Thuo for it to work.

- Send a message with the word “secret” to activate the bot.

- Follow the bot commands to get the forms and other information on CIC MMF.

The above also works with Instagram. Just DM me the word “secret” to activate the bot!

KYC Requirements

The following Know Your Client (KYC) documentation is required to join CIC Money Market Fund (preferably in PDF format).

Notes on the KYC requirements

Ensure you include both Top and Back sides of the ID card.

If using a Passport, then include the Bio data pages.

The bank details have to be for a Kenyan Bank operating in Kenya Shillings.

Acceptable bank detail documentation is:

The bank account number must be visible in the bank detail submitted.

It also has to match to the bank account number filled in the application form.

Never share the back side of the ATM card.

Unscrupulous people can use it to make fraudulent purchases.

Only share the top side which normally shows the bank account number.

Nash Thuo

If there is no official passport picture, a clear picture of the signatory is also acceptable.

The KYC requirements are also listed in the last page of each application form.

KYC documentation is a MUST and the account won’t be opened without it.

You can also get the forms by sending me a chat via this or Telegram link.

Top Benefits of Investing in CIC Money Market Fund

- Consistent Returns: Enjoy stable and reliable returns on your investment.

- Liquidity: Easily access your funds when needed.

- Professional Management: Expert fund managers handle your investments.

- Tax Advantages: Benefit from potential tax advantages available with this investment option.

CIC Money Market Fund Video Guides

Here is a video on how to complete the CIC Money Market Fund Application Form

Here is a video on how the CIC Money Market Fund return is calculated

Subscribe to the YouTube Channel for more video tutorials.

Check out the Money Market Fund Kenya Bot.

It has an in-built CIC Money Market Fund calculator and also the latest CIC MMF interest rate as of June 2023.

CIC Money Market Fund interest rates

CIC Money Market Fund vs. CIC Equity Fund

While CIC Money Market Fund offers low-risk investments and stable returns, CIC Equity Fund focuses on higher-risk equities for potential higher returns. The choice between the two depends on your risk tolerance and investment goals.

10 insider tips for your CIC Money Market Fund

Here are 10 tips to make the best out of your investment with the CIC Money Market Fund:

Understanding the Risks of CIC Money Market Fund

- Market Fluctuations: Although low-risk, the Fund’s returns may vary based on market conditions. See point below.

- Interest Rate Changes: Changes in interest rates affect the returns of money market funds in Kenya.

- Credit Risk: There is a low risk of default by issuers of the Fund’s underlying securities. However, this is mitigated by the use of professional fund managers as well as the oversight by the custodian and trustee

CIC Bank and M-Pesa details

Learn about the New MPESA charges for sending or receiving money via phone, ATM or MPESA agent.

The guide includes a curated list of transactions that are FREE via MPESA!

How to deposit into CIC Money Market Fund for free!

This section is not relevant for those with Co-operative bank accounts. This is because transfers will be free and instant as you share the same bank with the CIC Money Market Fund.

However, for those with other banks and want to avoid Bank and M-Pesa charges, here is a way to deposit money to CIC Money Market Fund for free!

- Go to the M-PESA menu and select Lipa na M-Pesa

- Then, Pay Bill option and enter paybill number 400200

- Then, enter account number 01122190806600

- Add amount and then the M-Pesa PIN

- You will receive a confirmation SMS from M-Pesa and from Co-operative Bank

- Forward the two messages above to cic.asset@cic.co.ke

- Remember to include your member number in the email above. This ensures quick allocation of the deposit to your CIC MMF account.

Please note, unlike when you use the CIC Money Market Fund’s paybill (600118), this method doesn’t allow you to input your member number.

Therefore it is VERY IMPORTANT to share the proof of deposit as per the guidance above.

The method remains FREE as of the time of writing but this may change in the future.

9 Top Reasons to Join CIC Money Market Fund

Are you considering joining CIC Money Market Fund? Here are the top 9 reasons why it’s a great choice:

- Consistent Returns: Enjoy reliable and stable returns on your investment.

- Compounding: Benefit from compounded growth over time, maximizing your earning potential.

- Ease of Investment: Invest effortlessly with a straightforward and user-friendly process.

- Ease of Top-ups: Conveniently add funds to your investment at any time.

- Ease of Withdrawal: Seamlessly withdraw your funds when needed without hassle.

- Ready Access to Information: Stay well-informed with easy access to relevant investment details.

- Professional Fund Management: Rely on experienced professionals to manage your funds effectively.

- Flexibility: Enjoy the flexibility to adjust your investment strategy as per your needs and goals.

- Tax Benefits: Take advantage of potential tax benefits that come with investing in CIC Money Market Fund.

We will go over each in detail below.

Here is the link to without the need to fill long application forms!

Click on the plus sign (+) to see what is underneath each pane:

Other Valuable Guides

Here are links to other valuable content on this blog:

- Complete step by step guide to PayPal in Kenya

- Here is the link to the Free Personal Finance Lessons for Kenyans. The first 10 free lessons are ready for your learning!

- The Comprehensive Guide on How to Earn Money in Kenya

- Easily get your TSC payslip online

- Below are some short and sweet personal finance and investing lessons. Watch. Learn. Enjoy. Share.

Useful links

Here are some useful links to learn more about money market funds in Kenya:

- Get started with money market funds in Kenya and fully understand them.

- This link answers frequently asked questions about money market funds in Kenya.

- This links goes into detail on the benefits of money market funds in Kenya and why you need one.

- If you want to diversify, Sanlam Money Market Fund is a great option for a second account.

Join the Tribe!

Get notified when new posts are published as well as access exclusive content in the Telegram Personal Finance Lessons Channel.

The Telegram Personal Finance Group is the tribe you have been looking for!

Subscribe to my newsletter for similar but exclusive guides tailored to Kenya!

Outro

Hope you found this article helpful and got some valuable insights.

Feel free to share it with your family, colleagues or friends who would be interested in a CIC Money Market Fund account.

I will ensure their account is created within a day of receiving the required documents!

They will also get access to premium reports and guidance once their account is mapped under my code (02581).

Hello how do i attach the documents required online?

Good info and insight. Would like to join your list and also CIC

Thanks for the great feedback. You can send me an email to nashthuo@gmail.com

If you send the filled forms and the required documents as per the last page of the form to the aforementioned email address, will ensure your account is created within a day of receiving the same!