Learn how to apply for the Hustler Fund loans using your phone by dialling the Hustler Fund Kenya USSD code *254# or via the mobile app.

Hustler Fund Requirements

Here are the requirements as per the Hustler Fund terms and conditions launched by President William Ruto and Cabinet Secretary Simon Chelugui on Wednesday, November 30, 2022:

- Be a Kenyan citizen (18 years and above)

- Have a valid National Identity Card (ID number serves as unique identifier)

- Have a registered mobile number with a recognized mobile network operator i.e. any of the three telcos Safaricom, Airtel or Telkom

- Have a registered mobile money account e.g. MPESA, Airtel Money or TKASH

- Your registered SIM card must have been used for more than 90 days. That means buying a new SIM card today just to register for the Hustler Fund loans won’t work!

- Must provide residence details

A valid good conduct certificate is not required but it helps to be on the right side of the law.

Steps to Register Hustler Fund Account

Below are the exact steps to register with the Hustler Fund.

Total Time: 2 minutes

-

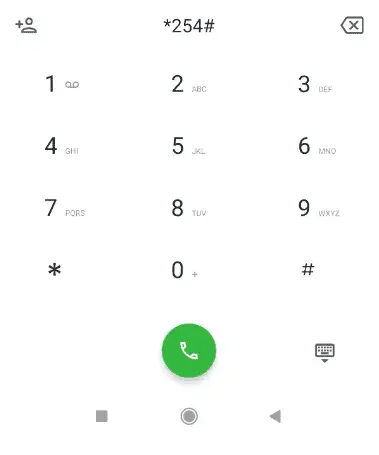

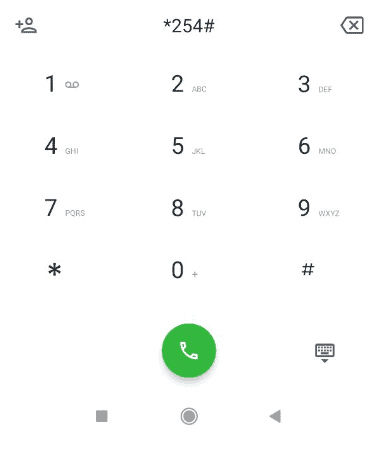

Dial USSD code 254

The Hustler’s Fund USSD code is *254#

Call the code from any of the mobile network operators i.e. Safaricom, Airtel or Telkom.

-

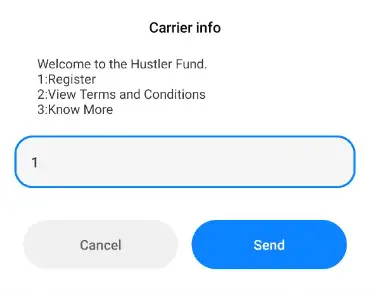

Choose Register option

Type 1 and then click send to register.

-

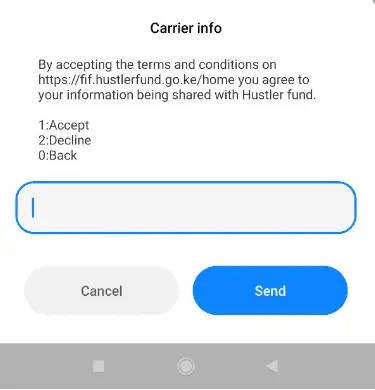

Accept the terms and conditions

Type 1 and click send to accept the terms and conditions for joining the Hustlers platform.

The terms and conditions can be viewed on https://fif.hustlerfund.go.ke/home

The official website is https://hustlerfund.go.ke/

If you’re wondering how to opt out of hustlers fund in kenya, then type 2 and click send.

-

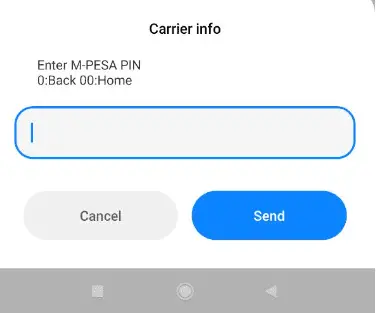

Enter Mobile Money PIN

Enter the PIN for your Mobile Money wallet i.e. MPESA or Airtel Money or TKASH

-

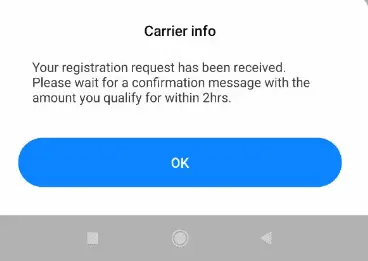

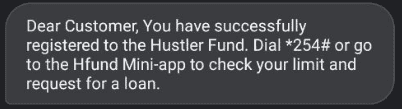

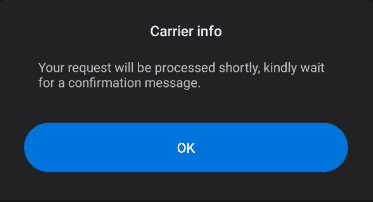

Receive SMS notifications

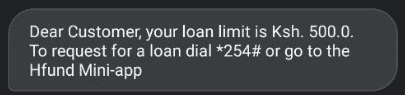

Receive an SMS confirming successful registration and the limit assignment.

You’ll also receive a notification if the Hustlers Fund registration is unsuccessful.

How to Apply for Hustler Fund Loans

Here are the steps to apply for Hustlers fund loan via USSD:

1. Dial *254#

Start by dialling the Hustler’s Fund USSD code *254# or use the mobile applications.

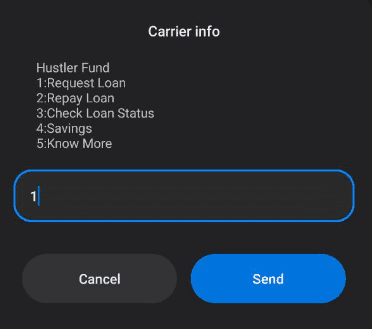

2. Select Request Loan

Type 1 and click send for the Loan request option to view your loan limit, interest and loan tenure.

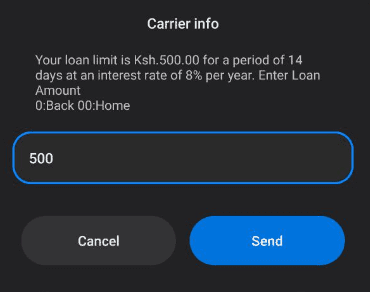

3. Enter the loan amount

Next, enter the loan amount and press “Send” to continue. The loan amount should not exceed the loan limits stated in the SMS. One can get to access the loan for 14 days at the interest rate of 8 per cent.

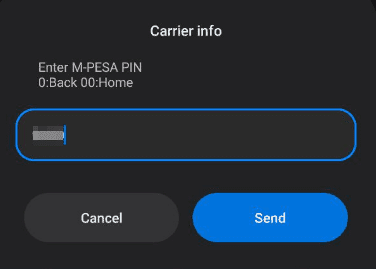

4. Enter your PIN

Enter your MPESA PIN or any other mobile money wallet e.g. Airtel Money or Telkom TKash.

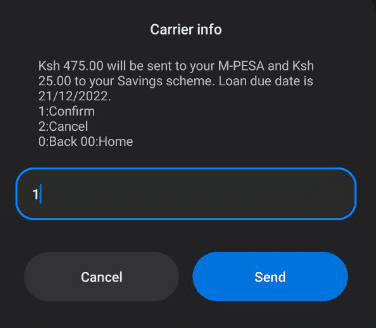

5. Confirm loan details

Confirm loan details and if okay, continue to the next step.

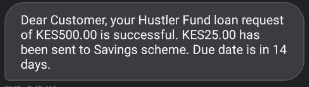

Here is a breakdown of how much of the Hustler Fund you will receive:

- 95 per cent of the loan applied for will be sent to your mobile money account.

- 5 per cent of the loan applied for will be sent to your savings account.

The amount sent to your savings account is further split as follows:

- 70 per cent will sent to your long term pension account.

- 30 per cent will sent to your short term savings account.

6. Receive SMS notifications

You’ll receive an SMS with your loan allocation and the relevant loan information.

On the first day, Kenyans with a good credit rating borrowed Kshs 17 Million per hour! Mostly due attractive interest rates for loans and short term savings account

Guide to access the HEF portal with SCREENSHOTS for each step!

with tips to get your loan approved!

How to Check Hustler Fund Loan Balance

Below is a step by step guide to check your approved loan balance:

- Use the mobile application platforms or dial *254# to get to your Hustler Fund account.

- Select the Loans option on your mobile phone menu.

- Choose the Check Loan Status option.

- Enter your PIN.

- You’ll receive a message showing your current loan balance.

Learn about the New MPESA charges for sending or receiving money via phone, ATM or MPESA agent.

The guide includes a curated list of transactions that are FREE via MPESA!

About Hustler Fund

The Hustler Fund is a digital financial inclusion initiative with a loans and savings scheme accessed via mobile phones. It was launched by President William Ruto and Cabinet Secretary Simon Chelugui on Wednesday, November 30 2022.

The Hustler Fund is one of the flagship projects for the Kenya Kwanza administration designed to improve financial access by providing attractive interest rates to all Kenyans.

Million Kenyans have complained about high interest rates charged especially by loan apps in Kenya.

The Hustler Fund is aimed to fix this by providing access to responsible finance to individuals, groups and small medium-sized enterprises.

Individuals, Micro, Small and Medium sized enterprises (MSMEs) can begin borrowing loans or access the savings account scheme.

This is done through dialing *254# via any of the mobile network operators or apply via the approved mobile application platforms. The banks a customer borrows from currently include Family Bank and KCB Bank.

The loan limits range from a minimum of Kshs 500 to a maximum of Kshs 50,000. When a customer borrows, the approved loan is disbursed to their mobile money account.

Money Market Funds are a good place to park your loan amount as you wait for a project for it. They currently earn within a range of 9% to 10% which is higher than the Hustler Fund interest rate below!

The Hustler Fund interest rate is set at 8 per cent pro rated basis per annum. Those who borrow, need to repay the loan within 14 days.

After 14 days, penalties apply. Your interest rate will be adjusted to 9.5 per cent 15 days after the default date.

The borrower loses all the credit scores accumulated and their Hustler Fund account is frozen if they don’t repay the loan 30 days after the default date.

Hence, it makes sense to repay the loan before the 15 days. That way you keep your existing credit history, credit rating and avoid the additional 9.5 per cent interest on the loan.

Funds in the short term savings account will earn at an interest rate of 9 per cent per annum.

Kenyans have borrowed over Sh30 billion from the Hustler Fund in just six months

An additional Sh11 billion was borrowed between February and May 2023. This highlights the strong demand for affordable credit, prompting the government to introduce a third phase of the fund targeting chamas (informal savings groups).

President William Ruto launched the Hustler Fund for Groups or Chamas during the 60th Madaraka Day celebrations in Embu County. The announcement of the borrowing amount coincided with the launch, indicating the growing popularity of the initiative among informal traders and groups.

President Ruto Launches Hustler Fund for Chamas

President William Ruto launched the second phase of the Hustler Fund during the Madaraka Day celebrations on 1 June 2023. This phase targets small investment groups, including Chamas and Saccos.

The President introduced the Hustler Chama Loan, which will be delivered through cooperatives and groups, aiming to help members enhance their businesses and living standards. This is after the success of the Hustler Fund Personal Loan product.

Loans in this phase range from Sh50,000 to Sh1 million, based on the average credit score of each group member. President Ruto hailed the first phase of the Hustler Fund as revolutionary.

The launch follows the announcement by SME Cabinet Secretary Simon Chelugui that the Hustler Fund group loan would rely on members’ credit scores. Kenyans are encouraged to form 10-member groups using their mobile phones to access the funds.

Chelugui explained that once a group of 10 members is listed, a survey will determine their suitability for a loan. If any members have defaulted in the initial Hustler Fund, they will be advised to clear their dues before accessing loans for their businesses.

Tags: husler fund loan https hustlerfund go ke www.hustlerfund.go.ke

How can I apply for the loan

Payment period should be 30 days