Know the new Safaricom M-PESA charges for withdrawing or sending money via Phone, ATM, or M-PESA agent outlet (and what’s FREE via MPESA).

MPESA charges vary depending on the type of transaction. Such as sending or withdrawing money and/or transacting with unregistered or registered M-PESA users.

Therefore, I have included 4 FREE calculators and a table of the new MPESA transaction charge effective 29 July 2023.

See table of contents below for easier navigation

MPESA Withdrawal Charges Calculator

Here is an M-PESA withdrawal cost calculator that uses the most recent MPESA withdrawal charges in September 2023 in Kenya:

Input the amount you want to withdraw; it will show you the exact MPESA charges!

M-PESA Withdrawal Charge: Ksh 0

Bookmark this page to use this free calculator next time!

Below is a table with the latest Safaricom MPESA charges, 2023, for withdrawing money in Kenya:

Table of the New MPESA Withdrawal Charges 2023

| Withdrawal Amount | MPESA Charges |

|---|---|

| From Ksh 1 to 49 | N/A |

| From Ksh 50 to 100 | Ksh 11 |

| From Ksh 101 to 500 | Ksh 29 |

| From Ksh 501 to 1,000 | Ksh 29 |

| From Ksh 1,001 to 1,500 | Ksh 29 |

| From Ksh 1,501 to 2,500 | Ksh 29 |

| From Ksh 2,501 to 3,500 | Kshs 52 |

| From Ksh 3,501 to 5,000 | Ksh 69 |

| From Ksh 5,001 to 7,500 | Ksh 87 |

| From Ksh 7,501 to 10,000 | Ksh 115 |

| From Ksh 10,001 to 15,000 | Ksh 167 |

| From Ksh 15,001 to 20,000 | Ksh 185 |

| From Ksh 20,001 to 35,000 | Ksh 197 |

| From Ksh 35,001 to 50,000 | Ksh 278 |

| From Ksh 50,001 to 150,000 | Ksh 309 |

Here are some insights from the table above:

- You cannot withdraw less than Kshs 50 from an M-PESA agent outlet.

- MPESA withdrawal charges are the same for amounts between Kshs 501 and Kshs 2,500. To avoid extra transaction charges, withdraw all you need at once within this range.

- For withdrawals, the maximum amount per transaction is Kshs 150,000.

- You can only withdraw up to a maximum of Ksh 500,000 in a day from a Safaricom agent (maximum account balance).

- Therefore, the maximum MPESA withdrawal charges in a day are capped at Kshs 618.

- See the M-PESA cost calculator for withdrawals shared earlier. It calculates the exact MPESA withdrawal charge for the amount input!

M-PESA charges can add up over time if compounded. Therefore, do your best to save on them. Instead, save that money and invest in a money market fund or Central Bank of Kenya bonds or savings accounts.

More efficient and/or cheap ways exist to withdraw or send money at specific ranges above, such as PesaLink.

Nash Thuo

You will need the following items to transact at any M-PESA agent:

- Identification document - National ID or Military ID or Kenyan Passport

- Phone number

How to Withdraw Money from a Safaricom M-PESA Agent

Here is step by step guidance on how to withdraw from an M-PESA agent via USSD.

Total Time: 6 minutes

Dial *334#

Dial *334# from your M-PESA phone to withdraw from an agent.

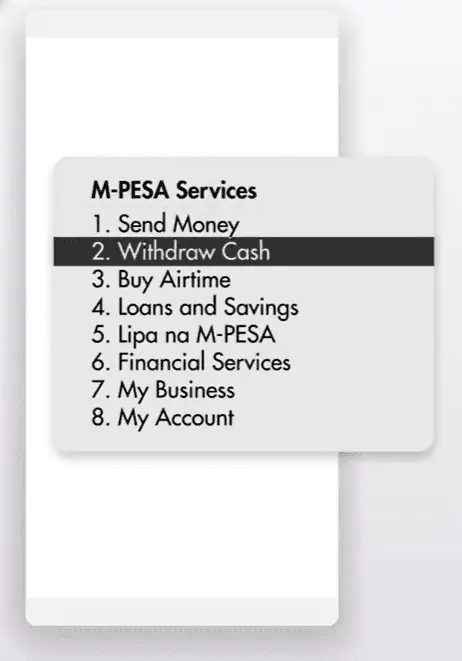

Select Withdraw Cash

Select the Withdraw Cash option

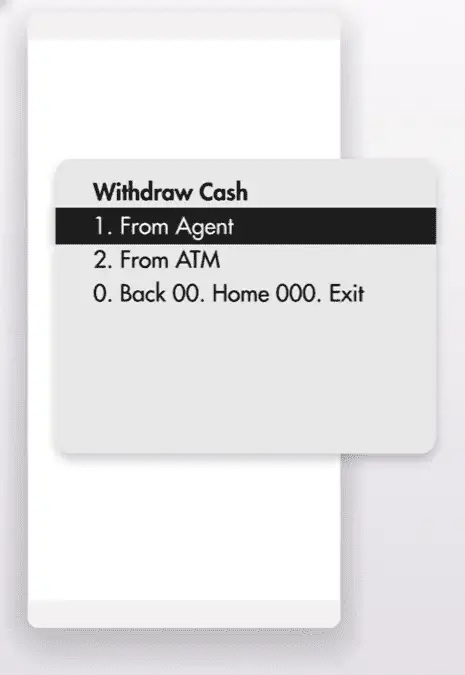

To Withdraw From Agent

Choose option 1 to withdraw from a Safaricom MPESA agent.

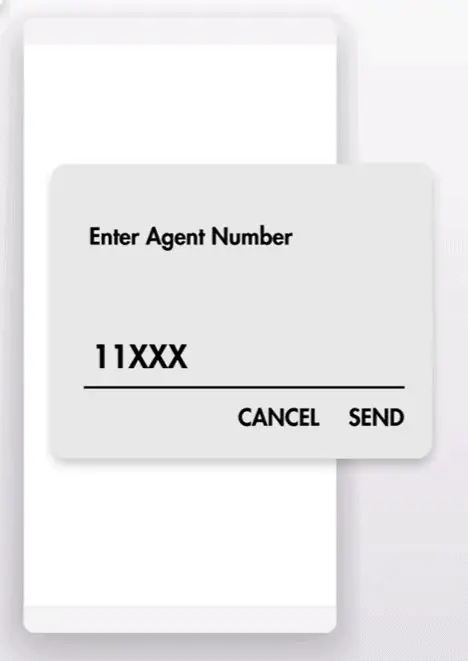

Enter Agent Number

Enter the agent number.

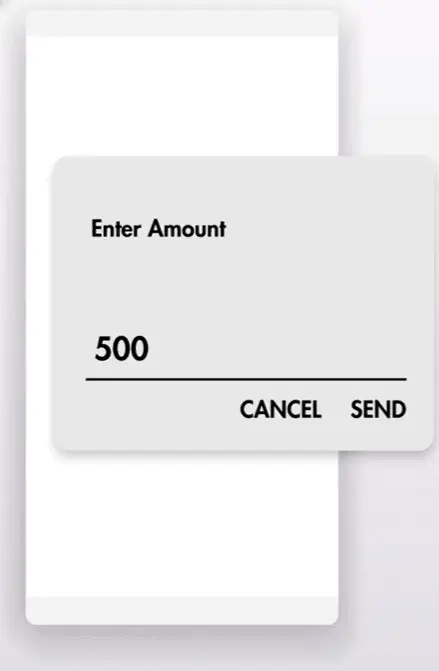

Enter Amount

Enter the amount you wish to withdraw from your M-PESA account.

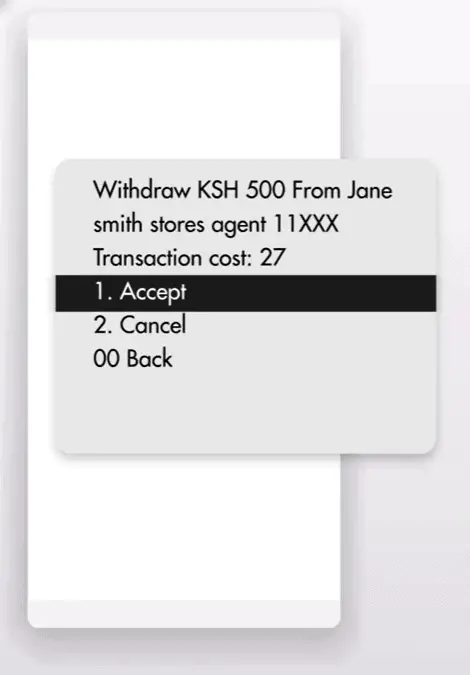

Confirm and Accept

Confirm and accept the transaction details.

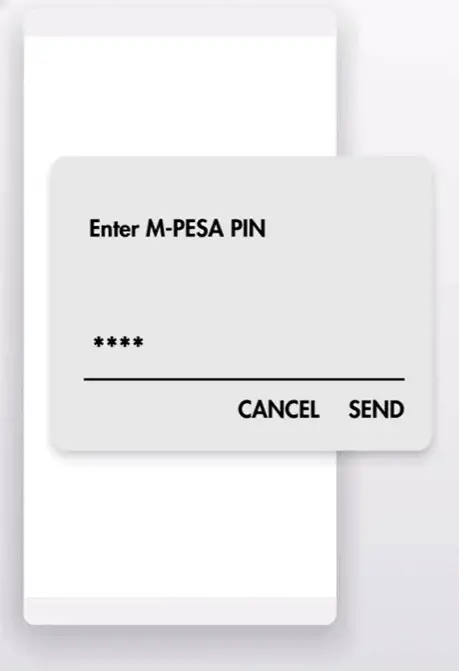

Enter your M-PESA PIN

Enter your M-PESA PIN.

Confirmation Message

You will receive an M-PESA transaction confirmation message on your phone.

Learn how to register your Safaricom line online.

Protect your line from being blocked!

MPESA Sending Charges Calculator

Here is an M-PESA money transfer calculator. It uses the new MPESA rates in September 2023 to calculate the charges to send money in Kenya:

Input the amount you want to send; it will show you the exact M-PESA charges!

MPESA Sending Charge: Free

Bookmark this page to use this free calculator next time!

Below is a table with the latest MPESA charges to transfer money in Kenya:

Table of New M-PESA Charges 2023 for Sending Money

Next, let's look at the new MPESA charges for sending money from M-PESA account to:

- Other M-PESA customers

- Business Till to Customer

- Pochi La Biashara.

| Transfer Range (Kshs) | M-PESA Charges (Kshs) |

|---|---|

| 1–49 | Free |

| 50–100 | Free |

| 101–500 | 7 |

| 501–1,000 | 13 |

| 1,001–1,500 | 23 |

| 1,501–2,500 | 33 |

| 2,501–3,500 | 53 |

| 3,501–5,000 | 57 |

| 5,001–7,500 | 78 |

| 7,501–10,000 | 90 |

| 10,001–15,000 | 100 |

| 15,001–20,000 | 105 |

| 20,001–35,000 | 108 |

| 35,001–50,000 | 108 |

| 50,001–150,000 | 108 |

M-PESA users can now send cash to other mobile money platforms such as Airtel Money, Telkom's T Kash, and/or to banks in Kenya such as Equity Bank, Kenya Commercial Bank, Standard Chartered Bank, etc.

The table above shows the mobile money transfer service charges for sending to other registered mobile money users.

Here are some insights from the table of M-PESA transaction charges above:

- There are no MPESA fees when sending an amount less than KES 100 to MPESA users or other third party accounts, Pochi la Biashara and Business till to customer.

- It makes sense to send any amount above Kes 20,001 in one go rather than in batches, as the M-PESA charges are the same for any amounts between Kes 20,001 and Kes 150,000.

- You can send money up to Kes 150,000 per transaction via M-PESA.

- The maximum amount for transferring cash via M-PESA is Kshs 500,000 in a day. This is also your maximum account balance.

- You cannot deposit money directly into another M-PESA customer's account at an agent outlet.

- EXACT steps to access Hustler Fund - with screenshots for each step!

- Apply for Hustler Fund Loan via USSD

MPESA Transfer to Unregistered Users Calculator

Here is a calculator on the charges to transfer to unregistered users via MPESA in Kenya.

The calculator uses the new MPESA charges for 2023 to calculate the cost:

Input the amount you want to send to an unregistered user; it will show you the exact M-PESA charges!

MPESA Charge to Unregistered User: N/A

Bookmark this page to use this free calculator next time!

New M-PESA Charges to Send Money to Unregistered Users

M-PESA charges are different for any transfer to unregistered users of any mobile money service.

These include people or entities that haven't completed Safaricom's M-PESA registration process.

Here is a table of the M-PESA charges for sending money to unregistered M-PESA users.

| Transfer Range (Kshs) | MPESA Charges (Kshs) |

|---|---|

| 1–49 | N/A |

| 50–100 | N/A |

| 101–500 | 47 |

| 501–1,000 | 51 |

| 1,001–1,500 | 61 |

| 1,501–2,500 | 76 |

| 2,501–3,500 | 115 |

| 3,501–5,000 | 139 |

| 5,001–7,500 | 171 |

| 7,501–10,000 | 211 |

| 10,001–15,000 | 273 |

| 15,001–20,000 | 296 |

| 20,001–35,000 | 318 |

| 35,001–50,000 | 318 |

| 50,001–150,000 | 318 |

Here are some insights from the table above on MPESA charges across unregistered users:

- M-PESA users transfer cash at a lower cost if the recipient is registered.

- Unregistered third party accounts send money at a higher cost. The reverse is also true when the transaction is initiated from a line registered with M-PESA.

- You cannot send any amount below Kshs 100 to an unregistered number via M-PESA.

Get complete guides on how to do everything and anything in Kenya!

Includes screenshots for each step!

MPESA ATM Withdrawal Calculator

Here is a calculator on the M-PESA to Bank ATM withdrawal charges in Kenya.

Use M-PESA latest charges in September 2023 to calculate the cost:

Input the amount you want to withdraw via ATM; it will show you the exact M-PESA charges!

M-PESA ATM Withdrawal Charge: N/A

Bookmark this page to use this free calculator next time!

MPESA Charges for Withdrawal at an ATM in Kenya

You can also withdraw from your M-PESA account via an ATM.

Here is a table with the M-PESA charges for ATM withdrawals in Kenya.

| ATM Withdrawal Range | M-PESA Charges |

|---|---|

| KES 200 to 2,500 | KES 35 |

| KES 2,501 to 5,000 | KES 69 |

| KES 5,001 to 10,000 | KES 115 |

| KES 10,001 to 20,000 | KES 203 |

| KES 20,001 to 25,000 | KES 230 |

| KES 25,001 to 30,000 | KES 230 |

| KES 30,001 to 35,000 | KES 230 |

Here are some insights from the the table of Safaricom MPESA rates above:

- It is expensive to withdraw via ATM. You are better off using an ATM card or going to a Safaricom agent.

- You cannot withdraw amounts below Kshs 200 from MPESA via an ATM.

- You cannot withdraw amounts above Kshs 35,000 from MPESA via an ATM.

Notes on MPESA Transaction Charges

Here are essential things to note about MPESA rates and related transactions:

- The maximum account balance for your MPESA is Kshs 500,000

- The maximum amount per transaction via M-PESA is Kshs 150,000

- The maximum daily transaction value is Ksh 500,000

- Buying Safaricom airtime through your M-PESA account is free of charge.

- Send the transaction confirmation message to 456 so as to initiate M-PESA person to person self reversal.

- You will earn Bonga points for all your MPESA transactions.

- You can view the M-PESA tariffs by dialing *234#

- You can only deposit money into an M-PESA account registered under your National ID.

You can view the applicable M-PESA charges through mySafaricom App or via the M-PESA cost calculator shared above!

The calculator also has the M-PESA transaction charges for using Lipa Na M-PESA Pay Bill.

Free MPESA Transactions

- Deposits: All deposits to your M-PESA account are free.

- Registration: MPESA registration is free.

- Airtime purchase: You can buy airtime for yourself or someone else for free through the M-PESA menu and earn Bonga Points.

- Balance enquiry: Checking your MPESA account balance is free.

- PIN change: Changing your MPESA PIN through the Sim Toolkit or MPESA app is free.

- Bank transactions: Most bank account number to MPESA transactions are now free. To confirm whether this is the case for your specific bank, check with them directly.

How to buy Airtel Airtime from MPESA

- Details on Free Airtel Paybill

- Step by step guide with screenshots for how to buy airtel credit from MPESA

Frequently Asked Questions

When are the new MPESA charges effective in Kenya?

The new M-PESA transaction charges are effective starting 29 July 2023, following the enactment of the Finance Act 2023. The increase is from 12% to 15% reflecting changes in Excise duty for mobile money services in Kenya.

How much to send Kshs 10000 via MPESA?

Based on the new charges, sending Ksh 10000 via MPESA will cost Ksh 90 to registered users and Ksh 211 to unregistered users.

What is the maximum amount MPESA can hold 2023?

The M-PESA limit was increased from Ksh 300,000 to Ksh 500,000 effective Tuesday, 15 August 2023. This is after approval by the Central Bank of Kenya.

However, the maximum limit per M-PESA transaction remains at the current Kshs 150,000.

How to avoid M-PESA charges?

It's essential to understand the M-Pesa pricing framework. Charging depends on the size of each transaction, so sometimes it might be cheaper to carry out a single large transaction rather than multiple small transactions.

Here is a list of tips to avoid M-PESA charges in Kenya:

- Transact in bulk rather than in small amounts

- Use direct payments via your bank. Transactions within the same bank are normally FREE.

- Carry cash in hand for quick and small transcations

- Use Pesalink where it is cheaper than M-PESA

How much to send Ksh 5000 via M-PESA?

The charge for sending Ksh 5000 via MPESA is Ksh 57 to registered users and Ksh 139 to unregistered users.

This is based on the recently published MPESA rates and tariffs effective 29 July 2023. See MPESA calculator above.

Can I reverse an M-Pesa transaction?

Yes. You can request a reversal by calling 100 or forwarding your confirmation message to 456 to reverse the M-PESA transaction.

How does the cost of sending money via Airtel Money compare with M-PESA?

Airtel Money and M-Pesa, both mobile money platforms, have different charging structures. While M-Pesa’s costs are mostly determined by the amount being transferred, Airtel Money charges can sometimes be less, particularly for larger amounts. It's advised to compare the rates on the respective official sites before deciding.

How do M-Pesa's charges for sending money compare with Equity Bank?

M-Pesa and Equity Bank offer money transfer services but differ in their charges. M-Pesa charges depend significantly on the amount being transferred, while Equity Bank's charges can sometimes be cheaper, especially for larger transactions. For accurate rates, checking both official websites is recommended.

Can I use M-Pesa for international money transfer?

M-Pesa provides a service for international money transfers, but the charges differ from domestic transfer rates. The charges will depend on the amount being sent and the destination country.

How do I calculate M-Pesa's charges for sending Ksh 7000?

Based on the M-PESA cost calculator above, the charge for sending Ksh 7000 is Ksh 78 based on the new MPESA rates in 2023.

Will I incur a charge for checking my M-Pesa balance?

No. Checking your M-PESA balance is FREE.

Other Helpful Guides

- Learn how to link PayPal to MPESA

- Guide on Paybill numbers in Kenya

- Achieve financial freedom using Money Market Funds in Kenya

- Learn how to make money online in Kenya and get paid via MPESA

- Join the Best Telegram Channel for Kenyans

Tags: mpesa charges 2023 kenya mpesa deposit commission chart 2023

10 thoughts on “Safaricom M-PESA Charges 2023: Withdrawal & Sending – FREE Calculator”