This is a free guide on PayPal in Kenya and PayPal to M-PESA account procedures.

You will get tips on how to do quick and cheap PayPal to Kenya transactions.

You will also learn the PayPal MPESA login process including how to link PayPal to MPESA.

PayPal is important for those who earn money online. It is also useful for basic personal finance management.

So you are lucky to have stumbled upon the most comprehensive guide to PayPal in Kenya.

It includes screenshots for each and every step! None is skipped!

Let’s start with how to open a PayPal account in Kenya.

How to Create a PayPal Account in Kenya

I will show you how to get to the final stage of the PayPal sign up process above.

The process to open PayPal accounts is the same no matter the country. In fact, PayPal’s geolocation feature takes you to the current location’s PayPal country website.

Therefore, this guide is relevant to any country in the world!

Total Time: 9 minutes

-

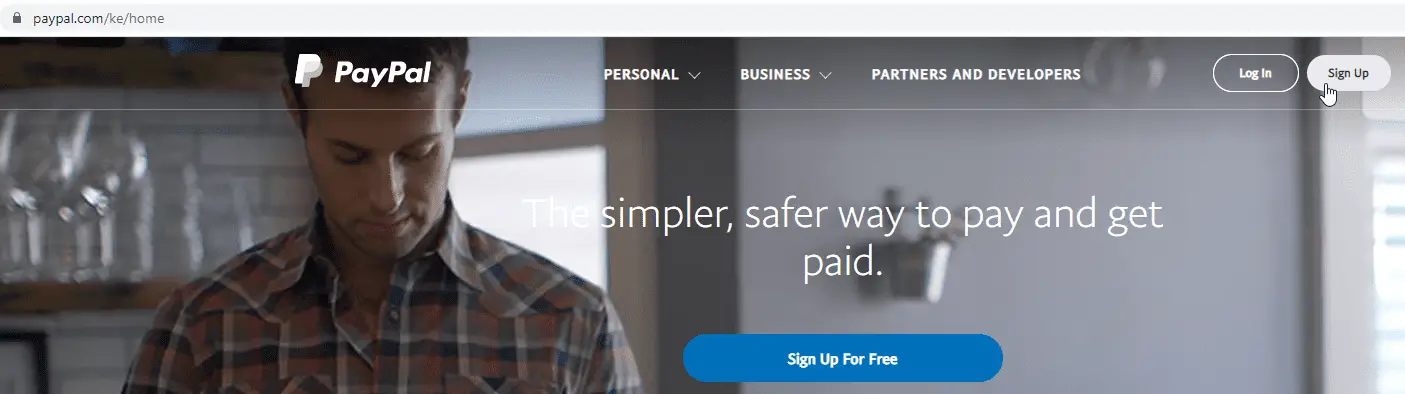

Visit the PayPal Kenya website

Go to the official PayPal website and click on the Sign up button.

-

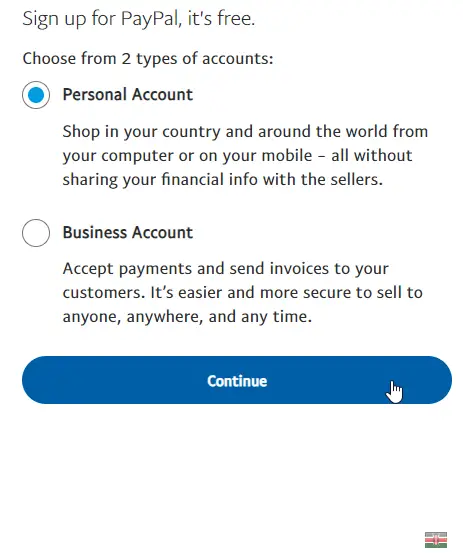

Choose the PayPal account type

Chose the PayPal account you want to create. It can be either a Personal account or a PayPal Business account.

The good thing is you can always upgrade your Personal account to a PayPal Business account if you wish.

Then click on the Continue button.

-

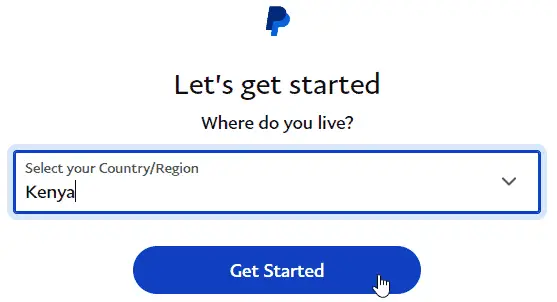

Add Location details

In your case, select Kenya and then click on the Get Started button.

Please note PayPal has geolocation ability. It will detect the country you are in.

So, it won’t allow you to progress if you are outside of the country it detects!

If you are outside your home country, your only option would be to use a VPN, a good one is Nord VPN, to change your computer’s location to the desired country.

-

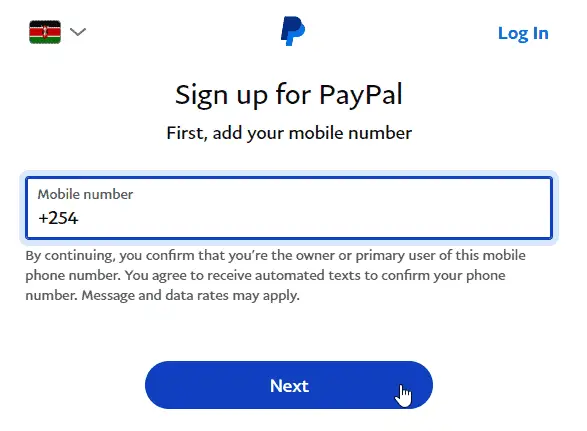

Add (Mobile) M-PESA Number details

Use your registered Safaricom mobile number so as to do the PayPal MPESA linking later on.

-

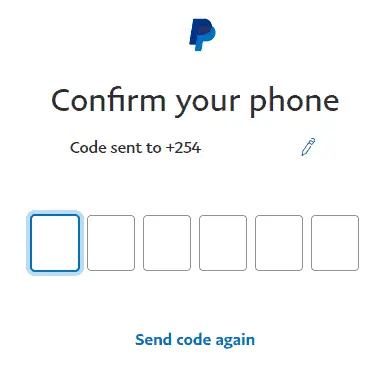

Enter the verification code

After a few minutes, enter the verification code received. It will be sent as an SMS to the registered Safaricom mobile number used in the previous step.

-

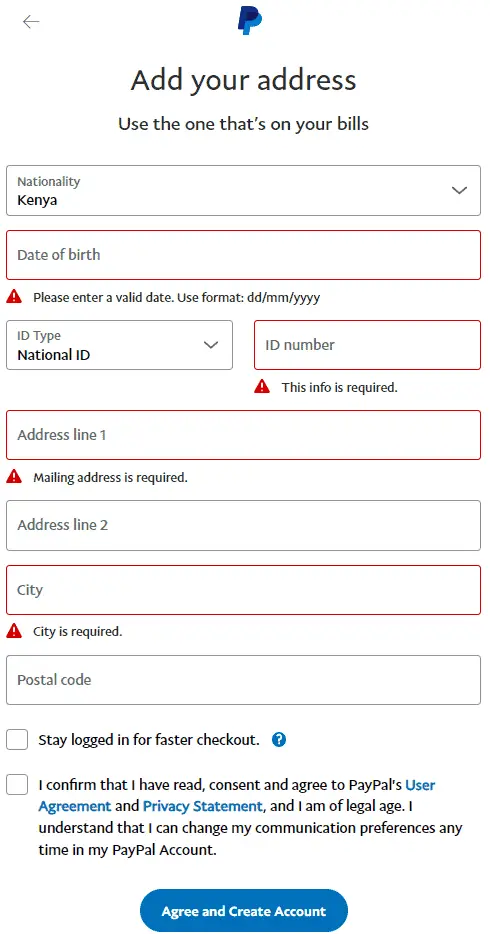

Input Address and Nationality details

Your nationality is automatically updated based on the choice of country in the previous section. However, you can override it for example, if not Kenyan.

Further steps and tips

– Your date of birth should be in the format requested i.e. Day/Month/Year (dd/mm/yyyy). For example, 31/12/1900.

– Input your Kenyan ID Number or Passport Number. I would recommend using your ID number as that never changes.

– Input your Kenyan residential address details in the “Address line 1” section. Such details can include, as applicable, the name of the estate, house number, nearest road, nearest town and so on. It is advisable that the details added in the “Address line 1” section agree to a utility bill or other official documents that are in your name. For example, it should agree to your water, internet or electricity bill. Or, agree to the details in your KRA PIN certificate and so on.

– Use, if applicable, your postal address in the “Address line 2” section. This is not a required field. So you can leave it blank if you don’t have a P.O. Box.

– Input the name of your city and or nearest town and it’s postal code. Read this article on the various Nairobi postal codes.

The more details you provide in the PayPal Kenya login process, the better. Make sure it is also factual and verifiable information.

Once the above is completed, tick the confirmation box at the bottom. Make sure to read the User Agreement and Privacy Statement sections. Both links open in a new tab when clicked.

Once read, tick on box next to the PayPal’s terms and conditions.

The faster checkout box is optional. It allows you to transact with PayPal without having to enter your password every time. This is a personal choice. I left mine unticked.

Finally, click on the Agree and Create Account button at the bottom of the website.

-

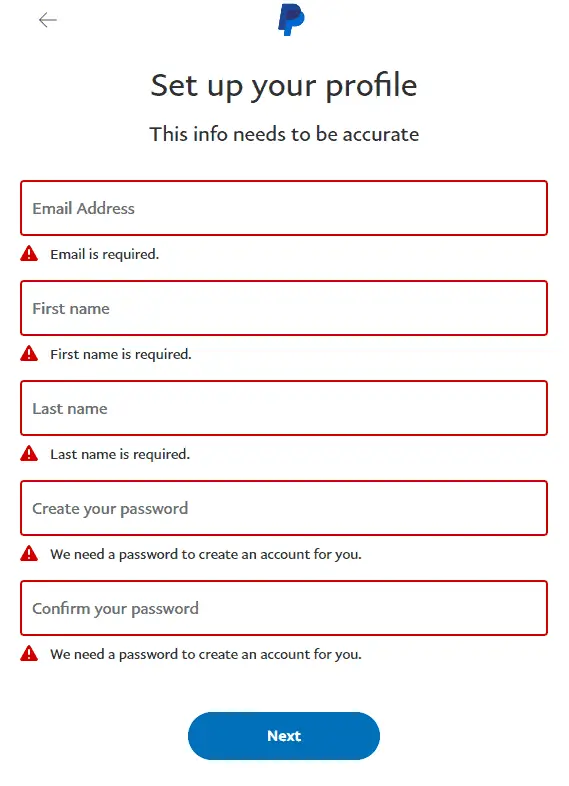

Set up your profile

Input your PayPal email address, name and a password.

Here are some tips for this section:

– Use your first and last name as per the Kenyan ID Card or Passport used in the previous step.

– The password has to be 8 characters or longer. It should include at least 2 of following: letters, numbers and symbols.

– Use your main email address! PayPal, uses your email address as the equivalent of a bank account number. So, use your best email!

Once you enter your username and password. Agree to PayPal’s terms, then, click on the Next Button.

-

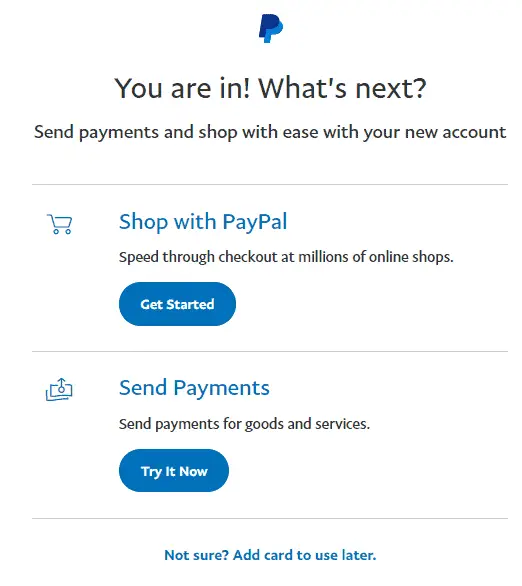

The PayPal account is created!

Awesome! You now the proud owner of a PayPal account!

You can now use it to do online transactions

Remember, to finalize the PayPal Kenya login process, you will need to confirm your PayPal email address.

So, check your inbox for an email from service@intl.paypal.com

Next, I will show you how to link your new PayPal to MPESA.

But first, let’s link your PayPal account to your bank in Kenya. This will unlock more benefits and remove transaction value limits.

-

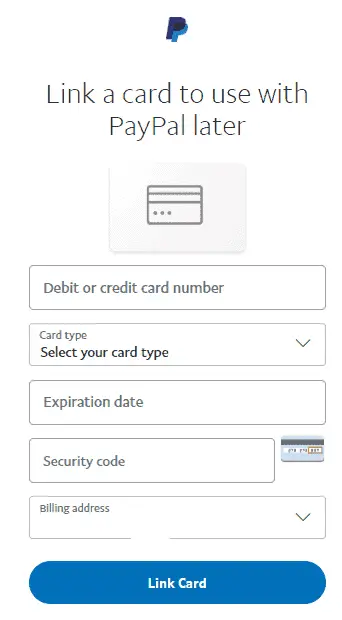

How to link a card to your PayPal accounts in Kenya

To view the above page, click on the Not sure? Add card to use later. link as seen in the previous step.

You can also get to it by clicking on the Link a Card or Bank link in your PayPal dashboard.

We discussed the PayPal Kenya login process in the previous step.

However, as a quick reminder, all you need to do is input your PayPal username and password. Agree to PayPal’s terms and then you will have finalized the PayPal Kenya login process.

Further steps and tips

– Enter your debit or credit card number. It’s the card number and NOT your bank account number!

– PayPal is intelligent and will select the card type automatically for you!

– Enter the Expiration date for the card. The required format is Month/Year (mm/yy). For example, 12/23.

– Enter your Security code. These are the 3 small numbers at the back of your debit or credit card. They are normally after the section for “Authorised Signature” at the back of your card. If you can’t find it ask the card issuer where to get it. It’s also called the CSC or CVV number.

– PayPal will populate the Billing address based on what you had filled earlier. However, you can input a new one if you want.

Once done, click on the Link Card button.

To verify your PayPal account, they will charge a small amount to the card and then reverse it moments after.

That’s it! Your card is now linked to your PayPal Kenya account. You have also unlocked benefits and removed some of the limits for your account.

Well done! Next, let’s link PayPal to MPESA. We will also understand the PayPal MPESA log in process.

How to Link PayPal to MPESA in Kenya

After working hard, earning online in Kenya, you will want to withdraw money from your PayPal account to M-PESA and use some of it.

To do that, you will need to link PayPal to MPESA so as to transact between the two platforms.

Below is step by step guidance on the PayPal MPESA linking process:

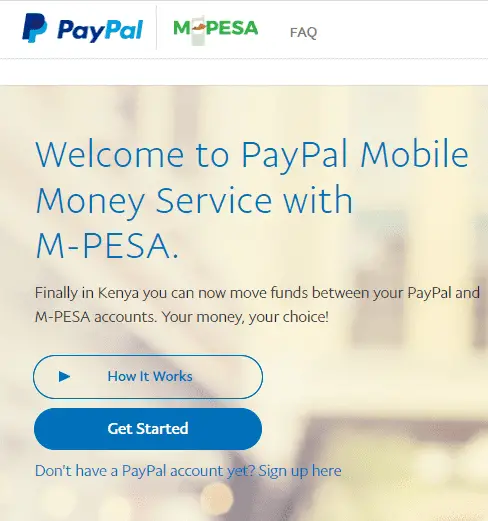

1. Visit the PayPal MPESA official website

Go to the official PayPal MPESA Link.

Then, click on the Get Started

For best results, make sure you are still logged in to your PayPal account.

Otherwise, finalize the PayPal Kenya log in process as explained in the section above. All you need to do is input your PayPal username and password to log in.

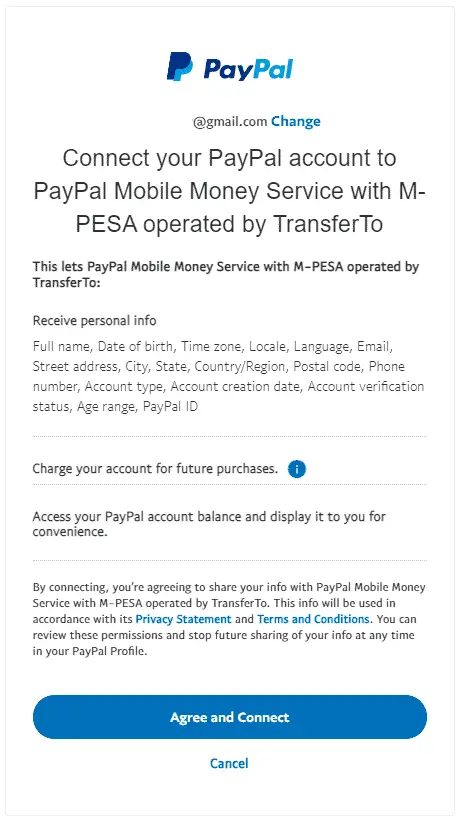

2. Connect to the PayPal Mobile Money Service

Take a few minutes to read the PayPal M-PESA terms. Then, click on Agree and Connect to complete the process to link your PayPal account to M-PESA.

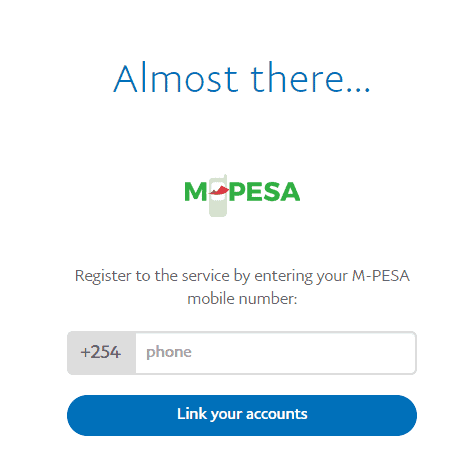

3. Enter your PayPal MPESA phone number

Register to the service by entering your M-PESA phone number.

When done, click on the Link your accounts button

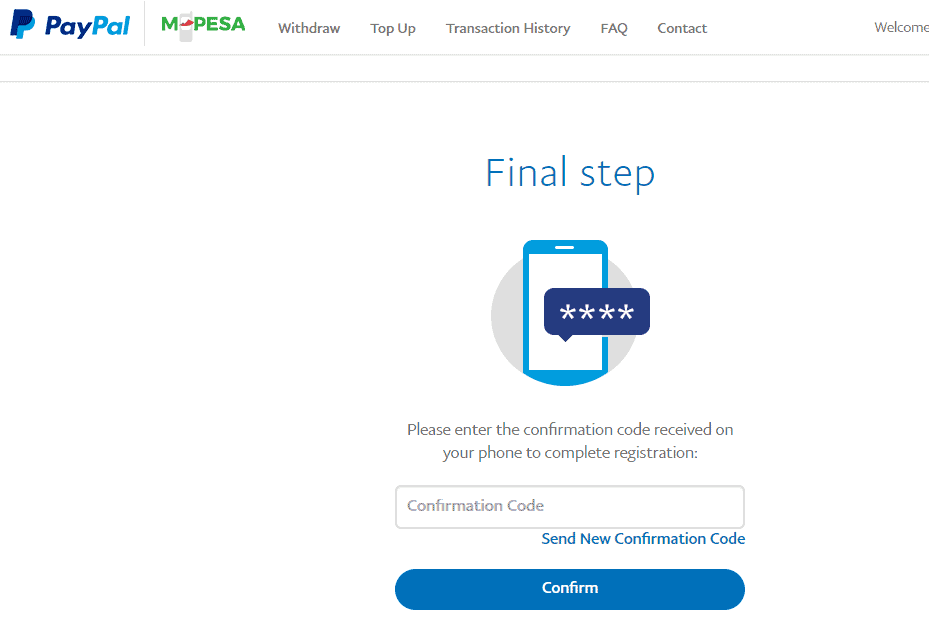

4. Enter the verification code

A verification code will be sent to your M-PESA phone number after a few minutes.

Enter the verification code and then click on the Confirm button.

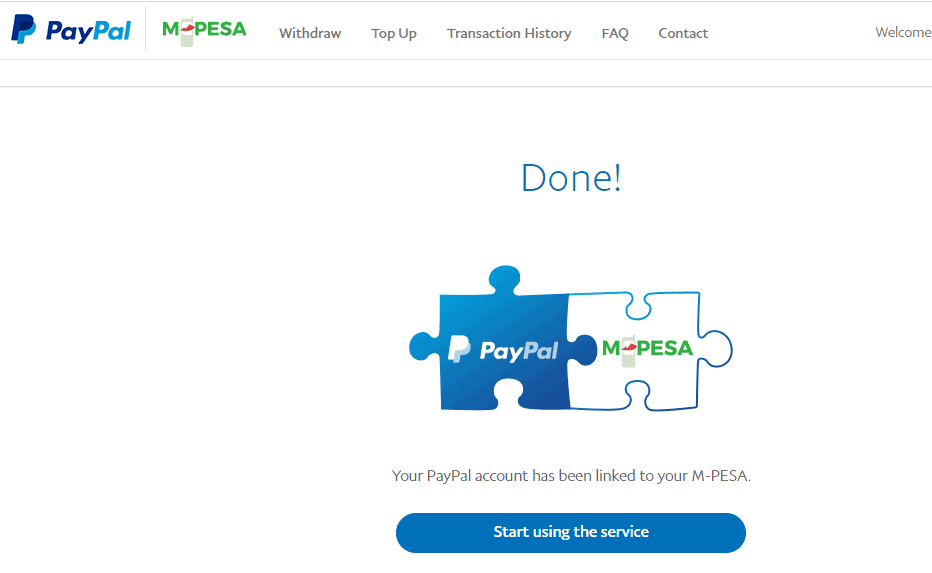

5. You are done with linking PayPal to M-PESA!

Awesome! Your PayPal account is now linked to your M-PESA account!

You can click on the Start using the service button to withdraw money from PayPal to M-PESA account or for top ups to your PayPal accounts.

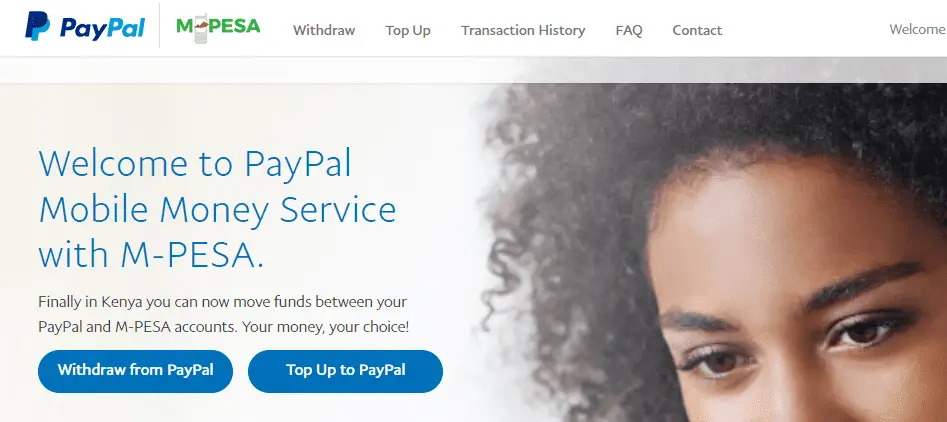

6. PayPal MPESA Main Dashboard

That’s it! Whenever you go through the PayPal MPESA log in process, you will see the below dashboard.

You have several options in the main dashboard page.

This includes ability to withdraw money from PayPal to M-PESA accounts or to send money to your PayPal accounts using your M-PESA balance.

Let’s explore both options further below.

Here is a video summary on how to link PayPal to M-PESA:

How to Withdraw Money From PayPal to MPESA

One of the benefits of linking PayPal to MPESA is the ability to withdraw money from PayPal for use here in Kenya.

Here is step by step guidance on how to withdraw money from your PayPal account to M-PESA:

1. Complete the PayPal MPESA log in process

If not done already, you will need to be logged into the PayPal Mobile Money website.

All you need to do is input your PayPal username and password. Agree to terms and conditions and then log in.

Note: clicking on the link below will take you back above.

Here is the PayPal MPESA link shared earlier.

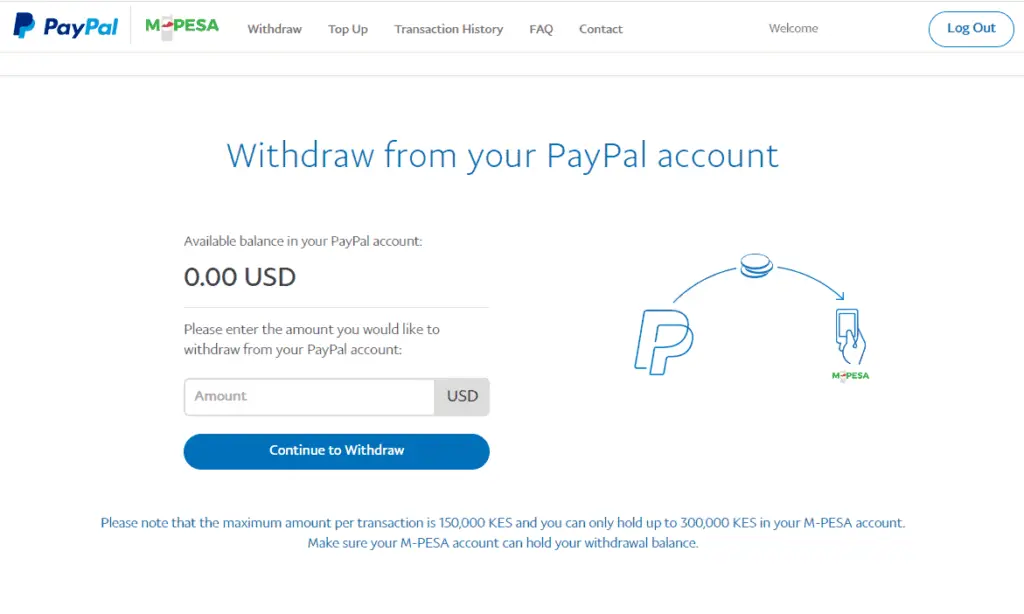

2. Select Withdraw from PayPal option

You will then be taken to the above page where you can continue to withdraw your money.

It shows your available PayPal balance which is the maximum amount you can withdraw from PayPal.

Unless, your PayPal balance is above KES 150,000, in which case that is the maximum amount per transaction to your MPESA account!

Also, note that your MPESA account can only hold a maximum KES amount of 300,000. Therefore, you should not withdraw money from PayPal that would lead to you exceeding this limit of KES 300K.

3. Enter the amount to continue to withdraw from PayPal to M-PESA

To withdraw money from PayPal, you need to do so in US Dollars (USD). So you need to know the exchange rate to get the USD value of the Kenya Shillings required in your MPESA account.

Once known, enter the amount you would like to withdraw and then click on the Continue to Withdraw button.

You will be taken to a page that shows the following:

- the Kenya shillings you should expect from your PayPal to MPESA account.

- the exchange rate that was used by the currency converter

- the estimated time before the money reaches your M-PESA account.

Confirm you are happy with the above details and then complete your PayPal MPESA withdrawal.

4. PayPal MPESA withdrawal complete!

You will receive the money in your M-PESA number.

It normally takes 2 hours to 3 calendar days to receive money from your PayPal account to the MPESA account.

You will receive an SMS from M-PESA (or the M-PESA app) and an email from PayPal confirming successful withdrawal.

Hope this makes your PayPal to MPESA withdrawals easier going forward.

Here is a video summary on how to withdraw money from PayPal to MPESA:

Find below a summary of each of the steps for your PayPal to MPESA account withdrawals:

- Complete the PayPal MPESA log in process

- Select Withdraw from PayPal. Enter the amount you would like to withdraw.

- Done! You will receive the money in your registered Safaricom mobile number.

Feel free to share this PayPal to M-PESA Guide if you found it valuable!

MPESA to PayPal Top Up Process

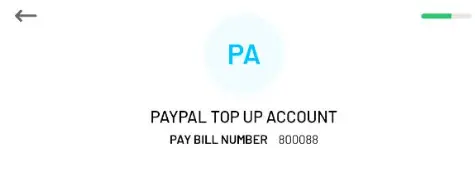

To achieve this, you will need to have a registered Safaricom mobile number with access to the Pay Bill M-PESA menu. The Pay Bill number to send money from MPESA to PayPal is 800088.

Here is a step by step guide on how to top up your PayPal balance using M-PESA:

1. Log into the PayPal Mobile Money Service

You need to be logged in to the PayPal Mobile Money website.

All you need to do is input your PayPal username and password. Agree to PayPal’s terms and then log in.

Ignore this step, if you are already logged in.

Note: clicking on the link below will take you up above to where it had been initially shared!

Here is the PayPal MPESA link shared earlier.

2. Select the Top Up option

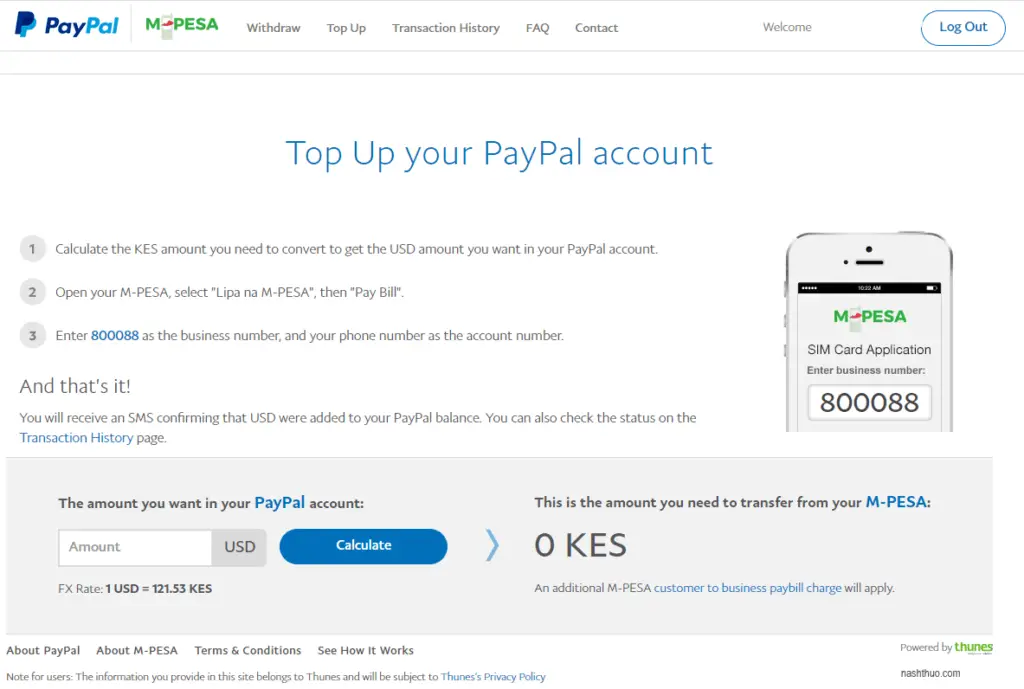

Clicking on the Top Up button will take you to the above screen.

3. Calculate the USD equivalent

The PayPal mobile money website has a currency converter for the USD amount you want in your PayPal account to the KES amount you need to transfer from your M-PESA account.

Check to ensure you are happy with the exchange rate and that it makes sense given the PayPal balance in your account.

Once you have calculated the KES equivalent, you can move to the next step below.

4. PayPal MPESA PayBill number (Lipa na MPESA)

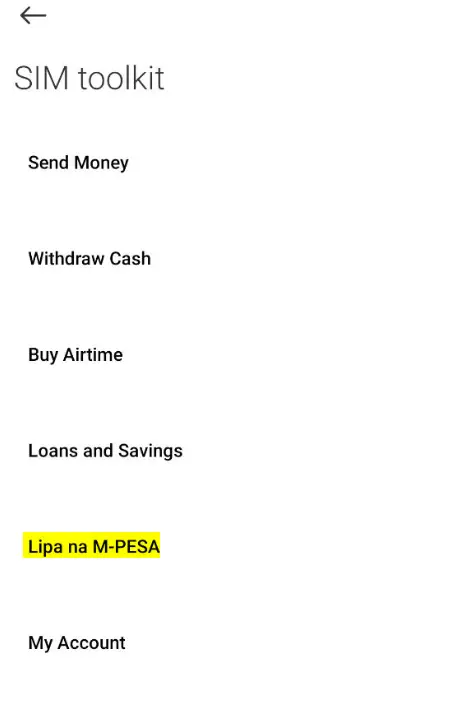

- Go to your M-PESA menu on your registered Safaricom mobile number, then select Lipa na M-PESA

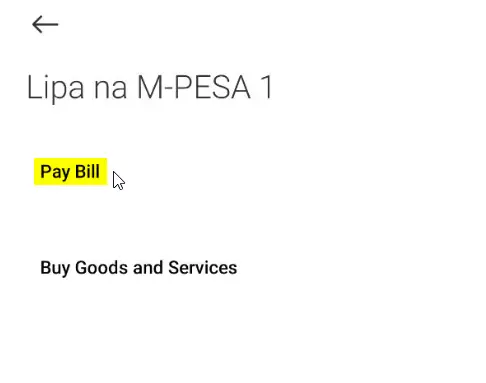

- Next, on your M-PESA menu, select Pay bill option.

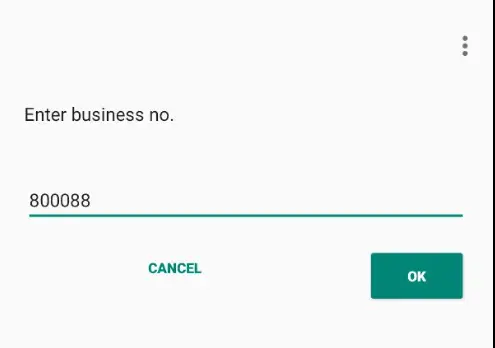

- Enter the PayPal PayBill number 800088 as the business number.

- Confirm you have entered the PayBill number correctly.

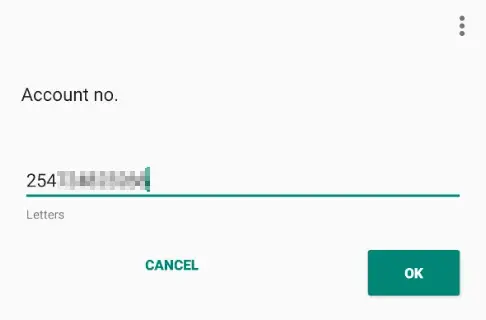

- Next, on your M-PESA menu, enter your phone number as the account number. Remember to use the PayPal MPESA linked mobile number!

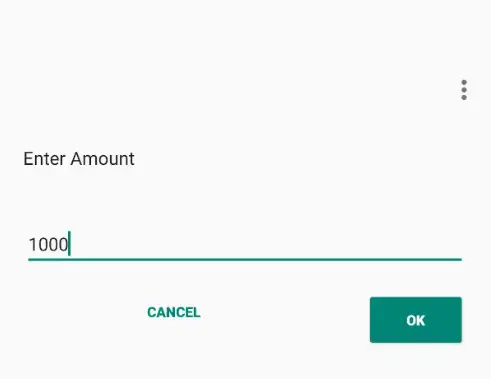

- Next, on the M-PESA menu, enter the amount calculated in the previous step.

- Remember to enter the amount in Kenyan Shillings. It is worth noting that there is a currency converter in the PayPal mobile money website which shows you the exchange rate including the applicable transaction fees.

- Finally, enter your M-PESA PIN and click Send money.

5. Done!

After a few minutes, you will receive an SMS in your PayPal MPESA mobile number (or the M-PESA app) confirming that the USD equivalent has been added to your PayPal balance!

Now you know how to send money from MPESA to PayPal using the Lipa na MPESA Pay Bill number!

Here is a video summary on how to transfer money to your PayPal account using the Lipa na M-PESA Pay bill number:

MPESA PayPal Charges

Here is a table of the MPESA PayPal charges:

| Transaction type | Transaction fee |

|---|---|

| MPESA PayPal Top Ups | 4% of the amount being sent to PayPal |

| PayPal MPESA withdrawal | 3% of the amount converted from USD to KES |

Please note the above is the transaction fee charged by PayPal. Normal related M-PESA charges from Safaricom will apply.

The maximum amount you can withdraw from PayPal to MPESA account or top up from MPESA to PayPal is KES 70,000 per transaction and KES 140,000 per day.

The minimum MPESA payment to PayPal is dependent on what you hold in your account.

PayPal MPESA Calculator

You can use the table above if you receive money via M-PESA account. It will help you estimate what you will receive in your MPESA account after transaction costs.

PayPal Kenya Charges

Here is a table with the PayPal Kenya charges:

| Transaction type | Transaction fee |

|---|---|

| Opening a PayPal account in Kenya | Free |

| Holding USD in PayPal account | Free |

| PayPal to PayPal Transfers | Free |

| Link PayPal with M-PESA | Free |

| Fund transfer from PayPal account | 5% of the amount (capped at $0.99 to $4.99) |

| Fund transfer from Bank card | 2.9% of the amount (plus fixed fee based on currency) |

| Vendor Payment request | 2.4% to 5% (plus fixed $0.3 fee) |

Other Valuable Guides

Here is an article on the Best 5 alternatives for PayPal. My top PayPal alternative in Kenya would be Wise (formerly TransferWise). Wise is 8 times cheaper than PayPal and banks. Find more about it below:

The link below will help you find the cheapest way to send money to Kenya:

Payment providers comparison – find the cheapest for sending your moneyCraving for more? Here are my 6 secret tips on how to use PayPal in Kenya!

Let me exceed your expectations with even more goodies below!

Check out these awesome guides that will change your life for the better in Kenya:

- The No.1 Guide to Money Market Funds in Kenya [with a Free Bot!]

- Earn Money in Kenya: Top 5 ways [ranked worst to best]

I am committed to improving the quality of knowledge in Kenya.

Here is a list of other published Kenya specific comprehensive guides:

Subscribe to my newsletter for similar but exclusive guides tailored to Kenya!

Join the Tribe!

Get notified when new posts are published as well as access exclusive content in the Telegram Channel.

Frequently Asked Questions

Is PayPal available in Kenya?

Yes. PayPal is a popular way to send or receive money in Kenya from anywhere in the world. You can even send cash from PayPal to M-PESA account.

Does PayPal work with M-PESA?

Yes, PayPal works with M-PESA. After you link your PayPal accounts to M-PESA, you can perform transactions between PayPal and M-PESA. This includes when you would like to withdraw money from PayPal to MPESA account or to transfer money from MPESA to PayPal.

How do I link PayPal to M-PESA?

To link PayPal to MPESA, log in and connect your M-PESA mobile number to the PayPal Mobile Money Service. After a few minutes, a verification code will be sent to your registered Safaricom mobile number. Enter the code to complete the PayPal MPESA linking process.

Can I transfer money from PayPal to MPESA?

Yes you can. All you need to do is link your PayPal accounts to your M-PESA mobile number. Once that is done, log into the PayPal Mobile Money website and then select Withdraw option. Follow the onscreen prompts and finalize your PayPal to MPESA withdrawal.

How long does it take from PayPal to MPESA?

On average it takes 2 hours to 3 calendar days to receive the amount withdrawn from PayPal to M-PESA account.

Why is PayPal M-PESA not working?

The main reason your PayPal M-PESA transactions may not be working is if you are using a non-Safaricom number or a Safaricom number that is different from the one registered with the PayPal Mobile Money Service.

What is the PayPal Lipa na M-PESA Pay Bill number?

The PayPal M-PESA Pay Bill number is 800088. Once you link MPESA to PayPal account, you can select Lipa na M-PESA on your registered Safaricom mobile number. Then go to Pay Bill option in the M-PESA menu and enter 800088 as the business number. Your phone number is the account number. Use this Paybill number (business number) when you transfer money from your M-PESA to your PayPal accounts.

Which bank in Kenya works with PayPal?

Equity bank is best known for its efforts to link with the PayPal service. It helps Kenyans to withdraw money from PayPal to their Equity bank account number.

Equity bank is one of the most popular PayPal agents in Kenya.

In fact, PayPal to Equity Bank account number withdrawals take only 24 hours. This is due to the continued partnership between Equity Bank and PayPal which is bearing fruits and helping Kenyans withdraw money much faster. Further, the exchange rate offered for transactions between PayPal and Equity Bank are reasonable.

It also gives them another option in addition to the MPESA to PayPal methods discussed above.

Why can’t I link my PayPal to MPESA account?

The main reason you are not able to link your PayPal to M-PESA account is that you are not using your Safaricom M-PESA number. Other mobile providers in Kenya are yet to be linked with the PayPal service.

Therefore, you will need to have a registered MPESA account and PayPal account. You can register for M-PESA by visiting any M-PESA agent. Here is the PayPal sign up Kenya guide.

Also, make sure the names used to register for your M-PESA account and the PayPal accounts agree to each other and to your Kenyan National ID Card.

Otherwise, if you experience any other PayPal MPESA linking errors, contact Thunes which is the company behind the PayPal M-PESA mobile money service.

Here is the link to Thunes Contact page: https://www.thunes.com/contact/

How to Unlink MPESA from PayPal?

Here is the process to unlink your M-PESA number from PayPal:

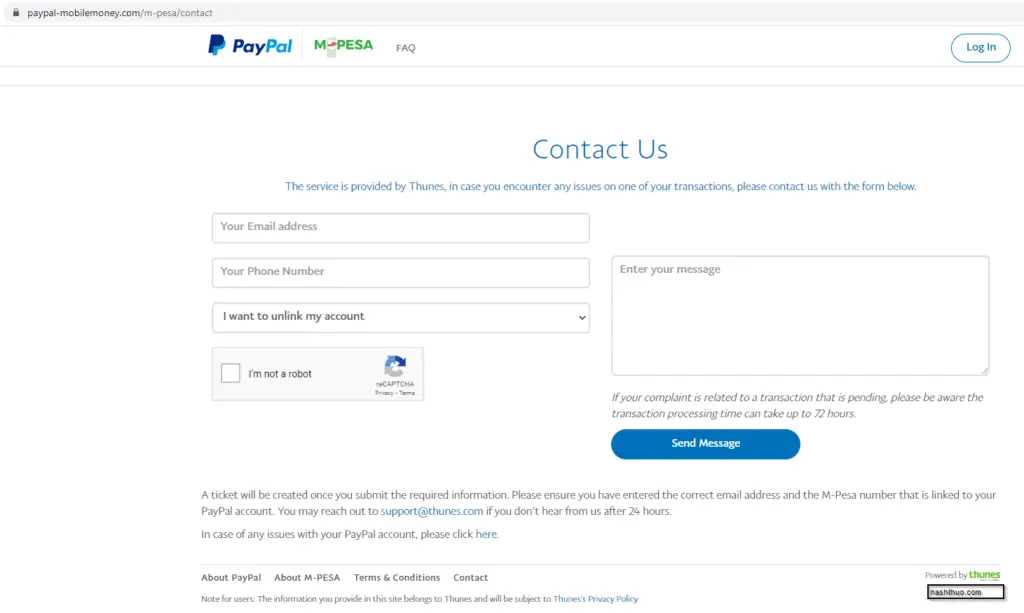

- Go to the PayPal Mobile Money Service website and then to the Contact page as seen above.

- Make sure you are logged in so you can see your details.

- Click on the dropdown titled Please select a topic and select the I want to unlink my account option.

- Input the reason to unlink your M-PESA from PayPal in the Message Box to the right.

- Complete the reCAPTCHA and then click send the message.

Do note that once you unlink your M-PESA account from PayPal, you will need to find another alternative if you would like to withdraw money from PayPal to MPESA.

What are the requirements to open a PayPal account in Kenya?

Here are the requirement to open a PayPal account:

- A working email address

- A bank debit or credit card e.g. from Equity Bank or any other bank in Kenya

- An M-PESA mobile number linked to PayPal

- Genuine and verifiable residential address

What is the PayPal address?

If someone asks for your PayPal address they mean the email address linked to your PayPal account. PayPal uses that linked email address as the equivalent of a bank account number.

What is PayPal?

PayPal is an online payment system that helps people or businesses to send and receive money in more than 200 countries/regions. Specifically, in Kenya, you can do PayPal to MPESA transactions which brings the power of mobile money to the online world.

This guide has been very helpful to me. Thank you.

Great idea for linking to make easier for the receiving of money