No. 1 Guide to Money Market Funds in Kenya [with a Free Bot]

This is a complete guide on how to invest with money market funds in Kenya so as to achieve financial freedom.

Learn the top 4 factors used by top experts to choose the money market fund to invest with in Kenya. Then get an exclusive curated list of the best money market funds in Kenya based on those factors.

For beginners, find easy explanations of the terms related to money market funds in Kenya. You will be a pro in no time! Finally, there is a free Money Market Funds Kenya Bot that calculates how much you’ll make from your investment and a number of other cool things that I will reveal later!

Be assured it’s worth your time and your financial life will change for the better! Just ask the over 190 Kenyans in the comments!

Introduction

Money market funds are a popular way to invest in Kenya both for short term and long-term investment goals.

If you have been wondering on how to grow your wealth in Kenya, money market mutual funds are a great place to start. You can manage personal finances by setting them up as emergency funds.

They can also be used for retirement planning by instructing the fund manager via the online investment platforms in Kenya to pay monthly interest to your bank account number.

For example, someone wondering which business to start with 1 million in Kenya or the best business to start with 100k in Kenya, can use money market funds as part of their personal financial plan to accumulate the cash needed.

This article aims to make money market funds, also known as MMFs in Kenya, easier to understand.

Lets start with a list of common terms related to money market funds in Kenya.

I will build up slowly before explaining what money market funds are in Kenya. I have set it up so that each term shared below helps to explain the next one! When you are done with the section below, you will be able to explain to a child how money market funds work in Kenya.

Let’s get to it.

What is pooling of funds?

Pooling of funds is when two or more people contribute funds for investing as a group. The pooling of funds is usually done by a money manager in the Kenyan market.

What are Collective Investment Schemes in Kenya?

Collective Investment Schemes, also known as CISs in Kenya, are entities where a professional money manager, invests pooled funds in various investment options in the Kenyan market. The role of the fund manager is to manage the pooled funds on behalf of the investors of the scheme so as to achieve the set objectives. There are 3 types of Collective Investment Schemes in Kenya:

- Unit Trusts Kenya

- Mutual Funds Kenya

- Employee Share Ownership Plans (ESOPs)

Only unit trust funds in Kenya are relevant to this article.

What are Unit Trusts in Kenya?

A unit trust in Kenya, is a type of Collective Investment Scheme that invests pooled funds in money market instruments and equities. Unit trusts Kenya types include:

- Money Market Funds

- Balanced Funds

- Equity Funds

- Wealth Funds

If you are wondering how to invest in Kenya while ensuring preservation of capital, then Money Markets Funds are an ideal investment option.

Equity Funds and Balanced Funds offer higher returns but one can lose the principal invested.

What are Money Market Instruments in Kenya?

Money market instruments, involve one party (the unit trust) giving money (Principal) to another entity in exchange for periodic cash flows (Interest). On maturity, the unit trust receives the Principal invested. Examples of money market instruments in Kenya include:

- Treasury Bills

- Treasury Bonds

- Corporate Bonds

- Commercial Papers

- Fixed Deposit accounts

- Bank deposits and near cash holdings

- Other high-quality interest-bearing investments

What are Equities?

Equities or stocks or ‘shares’ represent a share in the ownership of a business. Stocks in Kenya can either be unquoted or quoted such as those listed in the Nairobi Securities Exchange (NSE). You can invest in quoted/listed shares in the NSE through the online trading platform of brokers such as AIB Capital.

Here is a link to open an NSE account online. No paperwork needed!

What are Balanced Funds?

Unit trusts in Kenya that try to ‘balance’ between money market instruments with longer maturities (more than 1 year) and equities are called Balanced Funds. Some Unit Trust Kenya Funds will call them Bond Funds or Fixed Income Funds.

What are Equity Funds?

Unit trusts in Kenya that invest a higher proportion of their pooled funds in equities (primarily on the Nairobi Securities Exchange) are known as Equity Funds.

Hope you are starting to feel like a pro now! With that understanding…

Let’s now understand what brought you here.

What are Money Market Funds in Kenya?

MMF meaning Money Market Fund, is an example of a unit trust in Kenya. Money market funds in Kenya are low risk unit trusts that invest pooled funds in short term investments through a fund manager licensed by the Capital Markets Authority (CMA). They are sometimes called Shilling Funds whereas their owners are called unitholders.

Money market funds are ideal for managing excess cash or short term investment goals. They offer higher returns than saving accounts while having the liquidity of a current account. There are no penalties for withdrawing the principal and you get to keep the interest earned.

Money Market Funds are an example of an online investment with daily interest in Kenya. This is because money market funds such as Sanlam MMF and CIC MMF will calculate your interest daily and compound it monthly. Interest earned from MMFs in Kenya is charged 15% withholding tax (WHT). This is a preferential rate compared to the tax charged for example on employment income (30%).

The video below is best viewed in full screen mode preferably on a computer. Change from portrait to landscape mode for best viewing experience on mobile/tablet.

Excellent! Now you know what money market funds are and how they work in Kenya.

How can I join money market fund in Kenya?

The documents required to open a money market fund in Kenya are:

- Passport photo

- Copy of Kenyan National ID or Passport

- Copy of KRA PIN Certificate

- Copy of Kenyan Bank details

- Completed money market fund application form

What are the Best Money Market Funds in Kenya?

Best Money Market Funds in Kenya: The table below provides a summary of the top money market funds in Kenya, across categories such as market share, yield, management fee and deposit requirement.

| Category | Fund Manager | Supporting Data |

|---|---|---|

| Largest by Market Share | CIC Money Market Fund | 38.1% of the Kenyan Market |

| Highest Yield | Etica Money Market Fund | 11.8% annual yield |

| Lowest Management Fee | Sanlam Money Market Fund | 1.2% per annum fee |

| Lowest Deposit Requirement | Zimele Money Market Fund | KES 100 |

Here are my top money market funds in Kenya 2023 and beyond and how to join them.

- Here is step by step guidance on how to join Sanlam Money Market Fund

- Here is step by step guidance on how to join CIC Money Market Fund

Next, you will learn how to grow your wealth using money markets in Kenya!

Exciting stuff!

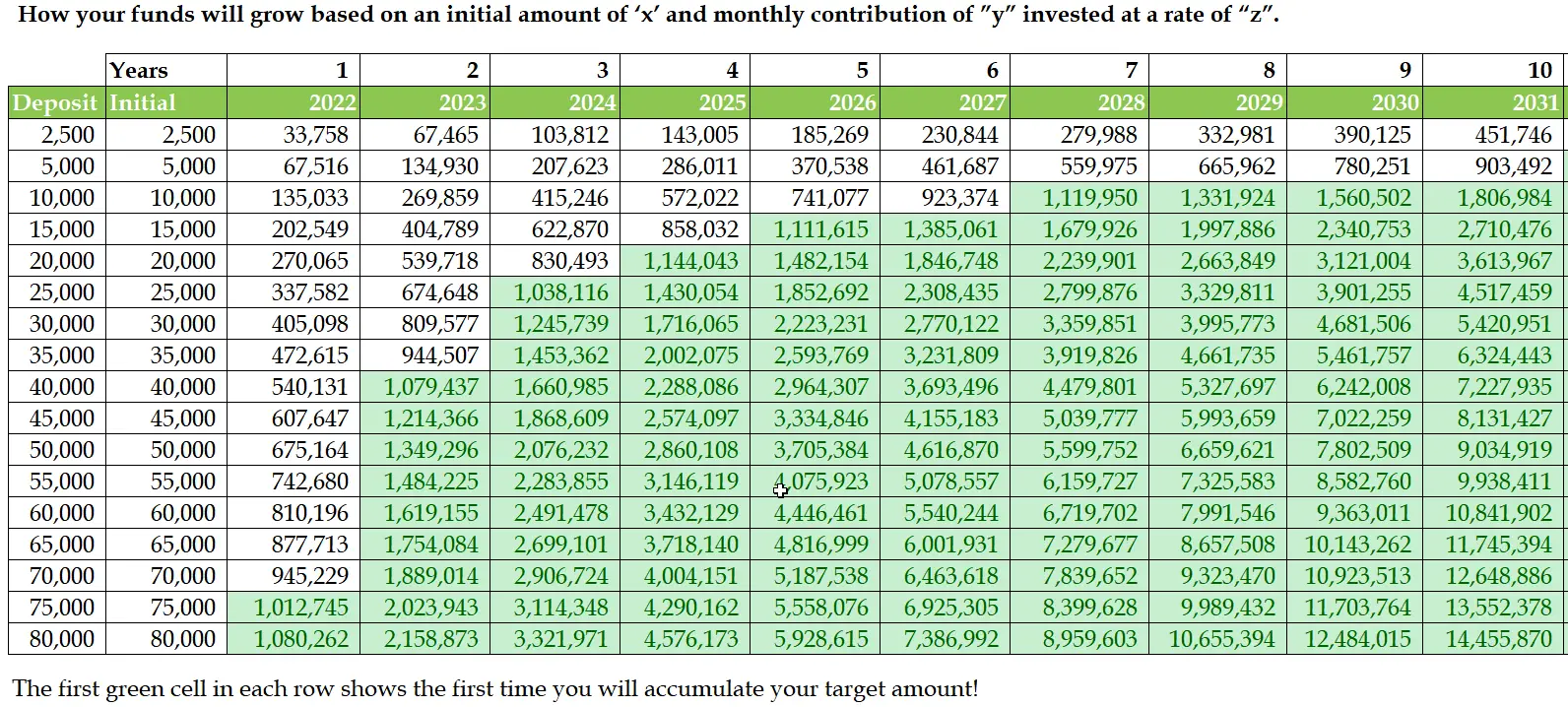

Zoom the image below if viewing on mobile.

How to become rich with Money Market Funds in Kenya

Below is step by step guidance on how to become rich using MMFs in Kenya.

Total Time: 5 minutes

Open a money market fund account

Choose the best money market fund for your needs and then follow the necessary steps to have it created.

Leverage on the power of compound interest

Through the power of compound interest, you can use money market funds as a set it and forget it investment that will make your rich over time.

See image above showing an example of how various amounts invested in a money market fund in Kenya would grow over time.

Use the Money Market Fund Kenya Calculator Bot

The free MMF Kenya Bot below will automatically show how your wealth will compound based on the inputs you give it!

Obtain your free wealth compounding report

When you open a new MMF account, use my signed forms and make sure it is mapped under one of my financial advisor codes:

Sanlam code is 04102. CIC code is 02581.

This will give your access to this form that you can use to generate a free custom PDF wealth compounding report.

Set up a standing order

This will ensure you never forget to deposit money each month. That means your funds will get to compound without any interruptions. Hence, reaching your wealth goals faster!

Estimated Cost: 2500 KES

Supply:

- Money Market Fund application forms

Tools:

- PDF Editor

Materials: Compounding

Awesomeness! (Hope that’s a word)

Now, let’s understand more on what compounding is and why, Einstein said this:

Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.

Albert Einstein

Get some popcorns and a nice quiet place.

Video lesson coming up…

Compound interest investments Kenya

Money Market Funds are one of the ways to earn compound interest in Kenya.

This is because most money market funds in Kenya will automatically compound your interest every month.

Here is detailed video on how to become rich in Kenya using the power of compound interest

The video below is best viewed in full screen mode preferably on a computer. Change from portrait to landscape mode for best viewing experience on mobile/tablet.

Sit back and watch till the end!

The video lesson above will help you understand how to grow your money not only with MMFs but also with other investments that compound in Kenya.

List of all Money Market Funds in Kenya

Below is a list of all the money market funds in Kenya in 2023:

- CIC Money Market Fund

- Sanlam Money Market Fund (Pesa+)

- Zimele Money Market Fund

- Genghis Capital Money Market Fund

- Co-op Money Market Fund

- Britam Money Market Fund

- ICEA Money Market Fund

- Equity Bank Money Market Fund

- UAP Old Mutual Money Market Fund

- Nabo Africa Money Market Fund

- NCBA Money Market Fund

- Alphafrica Kasha Money Market Fund

- Madison Money Market Fund

- Dry Associates Money Market Fund

- Apollo Money Market Fund

- ABSA Money Market Fund

- Etica Money Market Fund

- GenAfrica Money Market Fund

- Jubilee Money Market Fund

- Enwealth Money Market Fund

- Mali Money Market Fund

- Dyer and Blair Money Market Fund

- African Alliance Kenya Shilling Fund

- Diaspora Money Market Fund

- Adam Money Market Fund

- Cytonn Money Market Fund

- Kuza Money Market Fund

- Amana Money Market Fund

Next, let’s uncover the gems in the long list above and identify the best money market funds in Kenya for FY 2023/2024 and beyond.

Factors for choosing the best money market fund in Kenya

Here is a summary of the factors to consider to get to the best money market funds in Kenya:

- Assets Under Management (AUM)

- Financial Strength

- Customer service

- Money market fund interest rate

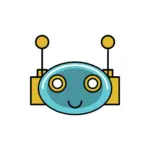

Assets Under Management (AUM)

This shows the share of the total invested funds in the money market Kenya arena that are managed by a particular fund manager.

The higher the assets under management, the larger the market share of the total money markets funds in Kenya.

A big percentage of the total assets under management also signals the trust people have in the money market fund to grow and keep their money safe.

Based on the latest Capital Market Authority Quarterly Statistical Bulletin available in June 2023, the best performing money market fund in Kenya by market share/AUM was the CIC Money Market Fund.

Kenyans trusted CIC MMF with Kshs 61.3 Billion out of a total of Kshs 161 Billion of the total assets under management as at June 2023. The fact that its custodian is Co-operative Bank (Tier 1), further ensures the safety of funds invested with CIC MMF.

That means 38.2% of all the money invested with MMFs in Kenya was under CIC Asset Management.

Here is the link to open your CIC Money Market Fund account online! No forms or paperwork needed!

Learn everything you need to know about CIC Money Market Fund

- Step by step guidance

- Latest data including rates

- Free compounding report!

Top 5 Money Market Funds in Kenya by Assets Under Management (AUM)

The following are the top 5 Money Market Funds in Kenya by AUM in FY 2023/2024:

- CIC Money Market Fund

- NCBA Money Market Fund

- Sanlam Money Market Fund

- ICEA Money Market Fund

- Britam Money Market Fund

Financial Strength

While Assets Under Management can point to the financial strength of money markets funds in Kenya, I like to also look at the companies backing it.

If it’s backed by a multinational entity or Tier 1 Bank, that is a good indication of its financial strength.

It also means that the money market fund has a big reputation to protect. Therefore, it will aim to manage funds safely to avoid negative press.

Best Money Market Funds in Kenya by Financial Strength

Below is a list of some of the money markets funds in Kenya that are backed by a multinational entity or Tier 1 Bank in FY 2023/2024 :

- CIC Money Market Fund

- Sanlam Money Market Fund

- NCBA Money Market Fund

- UAP Old Mutual Money Market Fund

Customer service

This is subjective criteria to determine the best money market fund in Kenya unlike the two above.

However, it plays an important role in your experience and longevity with the money market Kenya options available to you.

Generally, most of my readers seem to be happy with the service they get from CIC Money Market Fund, Sanlam Money Market Fund, Zimele Money Market Fund and Genghis Capital.

Learn everything you need to know about Sanlam Money Market Fund

- Step by step guidance

- Latest data including rates

- Free compounding report!

Best Money Market Funds in Kenya by Customer Service

As of 06 June 2023, the following are the top 5 money market funds in Kenya by customer service:

- Sanlam Money Market Fund

- CIC Money Market Fund

- Zimele Money Market Fund

- Genghis Capital Money Market Fund

- Nabo Africa Money Market Fund

See this article on how to join Sanlam Money Market Fund within a day!

See this article on how to join CIC Money Market Fund within a day!

Process is fully online. This saves you time and keeps you safe as no need for physical visits.

It also allows you to open a money market account if you are outside of Kenya.

Money market fund interest rate

You will notice yield is the last factor to consider when choosing the best money market fund in Kenya.

I consider the 3 factors above better indicators of a good money market fund to invest in. This is because yield is the most vulnerable to manipulation.

It also, sadly speaks to one of our worst instincts when it comes to investing in Kenya. GREED

Some money market funds will resort to aggressive investment strategies so as to show high returns. This may work in the short term but it catches up with them in the long run.

That is how several unit trusts in Kenya lost client funds by investing in Nakumatt and Imperial Bank bonds that were offering crazy returns then!

Secondly, most new MMFs in Kenya will be the ones offering the highest returns. Some do this to attract new clients that are chasing yields.

However, they fizzle out after 2-5 years. What is important is to look at sustained long periods of offering relatively reasonable returns.

See section below on how to assess reasonability of Money Market Fund returns in Kenya.

That said, yields are still an important factor that most Kenyans consider before investing in a money market fund.

Best Money Market Funds in Kenya by Yield

Here is a ranking of the yields of the Top Money Market Funds in Kenya with the largest AUMs:

- Sanlam Money Market Fund – 10.2%

- NCBA Money Market Fund – 10.2%

- CIC Money Market Fund – 9.6%

- ICEA Money Market Fund – 9.6%

- Britam Money Market Fund – 9.6%

The above represent the Effective Annual Rates for the Top 5 money market funds in Kenya as at 06 June 2023.

Here is the link to the full list of the latest money market fund interest rates in Kenya

Greatness! Now you definitely have the power to choose the best MMF for you!

Next, let’s learn why everyone you know should have one!

Reasons to invest with Money Market Funds

Money market funds are very popular as they are low risk investments that offer competitive and predictable returns compared to other investment options in Kenya.

Here is a summary of the top benefits of investing with Money Market Funds:

- Compounding

- Liquidity

- Ease of investment

- Preservation of capital

I will go over each in the section below.

Compounding

Money market funds are one of the safest ways to grow your wealth in Kenya through the power of compound interest.

For example, both the Sanlam Money Market Fund and CIC Money Market Fund will calculate your interest daily and compound it monthly.

The video below is best viewed in full screen mode preferably on a computer. Change from portrait to landscape mode for best viewing experience on mobile/tablet.

Liquidity

One of the main advantages of Money Market Funds is their high liquidity. In Kenya, you can withdrawal your money market investment within a maximum of 3 days.

This makes money market funds a superior investment to Fixed deposits and Sacco deposits which offer similar or lower return but are harder to convert to cash.

Fixed deposits in Kenya are worse as they will charge you a penalty for withdrawing your funds early.

Due to their liquidity, they are great for creating emergency funds.

Ease of investment

You can start investing with money market fund Kenya for a very small amount of money.

For example, with the Sanlam Money Market Fund, you can start investing with a minimum of Kshs 2,500.

This gives you access to a professional fund manager and higher returns compared to bank savings account in Kenya, at very low starting capital.

Preservation of capital

Being low risk investments, most money market fund Kenya options offer the stability and security needed for you to sleep comfortably at night knowing your money is safe.

However, be careful of money markets funds that expose your hard-earned money to unnecessary risk. You can avoid such unit trusts by considering the key factors noted above.

Ultimately, with the right investment strategy, money market funds can be an important tool in your road to passive income.

Check this article as well on the…

- the benefits of money market funds in Kenya and why you need one.

Fantastic! Now you know what to tell them when they ask why an MMF account is needed!

Speaking of questions they might ask…

Are Money Market Funds Safe in Kenya?

Money Market Funds are relatively safe because they invest in short term and low risk investments. They are also regulated by the Capital Markets Authority.

However, you can lose your cash in a money market fund that is mismanaged.

To further ensure the safety of your money market fund investment, you need to consider the trifecta of safeguards put in place by the Capital Markets Authority of Kenya (CMA Kenya).

Any money market fund in Kenya is required to have the following service providers to ensure the safety of the underlying investments:

- Trustee

- Auditor

- Custodian

- Fund Manager

- Investment Policy Statement (IPS) or Investment Mandate

The first thing to do is to consider the factors discussed above for selecting the best money market funds in Kenya. That will help filter the list down so as to avoid decision fatigue.

You then want to assess the quality of the service providers remaining in your list after the first step.

You should look for Kenyan money market funds that are audited by Big 4 Firms.

Here is a list of the Big 4 audit firms in Kenya:

- PricewaterhouseCoopers (PwC) Kenya

- Deloitte

- KPMG

- EY

You also want to look at the financial strength of the custodian, who is the one who holds the assets of the money market fund.

Preferably, the money market fund should have a Tier 1 Bank as its custodian. This adds a further layer of security to your investment.

Thirdly, assess the track record of the fund’s Trustee and Fund Manager in the Kenyan Market.

You want to avoid fund managers or trustees that have been involved in unit trusts that have lost Kenyans money and or have poor historical returns.

Finally, go through the investment mandate of the money market fund.

Avoid MMFs in Kenya with very aggressive investment strategies that may offer relatively higher returns in the short term but risk your hard earned money in the long term.

Eventually, the chickens will come home to roost and any small yield gains wont be worth losing your investment.

There are several sad stories of Kenyans who have lost their investments due to chasing unsustainably high returns.

Comforting! Now you know what measures the regulators have put in place and how to pick the safest MMFs in Kenya…

Next, let’s arm you with tips on how to know if the returns of the MMF makes sense…

How to assess the reasonability of Money Market Fund returns

A large percentage of the pooled funds in Kenyan money market funds ends up invested in Central Bank of Kenya Treasury Bills (T-Bills).

Therefore, the 91-Day and the 364-Day Treasury Bills rates offer a good benchmark of the returns you SHOULD expect.

Consequently, the minimum GROSS return you should expect from your preferred money market fund is the 91-Day Treasury Bills rate.

In June 2023, the 91-Day Treasury Bills rate in Kenya was 11.10%

Similarly, the expected maximum GROSS return should be the 364-Day T Bill rate.

In June 2023, the 364-Day Treasury Bills rate in Kenya was 11.50%

You can adjust the 91-Day Treasury bill rate by plus or minus 1% so that, your minimum expected rate would be about 10.1% and the maximum expected rate approximately 11.5%.

This is because Treasury Bills rates also go up and down based on market forces.

Therefore, the adjusted minimum and maximum is appropriate so as to take into account these highs or lows.

If a Money Market Fund is offering a significantly higher return than the adjusted 364-Day Treasury Bills rate. Where exactly are they investing your money? Are they exposing you to the risk of capital loss? Or to a risk of suboptimal returns in the future?

Nash Thuo

If a Money Market Fund is offering a return lower than the adjusted 91-Day Treasury Bills rate. Are they letting you take losses for past mistakes? Is their investment strategy optimal?

Nash Thuo

Marvelous! By reading this far, you can honestly teach a class on MMFs in some uni out there…

Big pat on your back for the acquired knowledge.

And here is an awesome bot to help in your investment journey…

The Money Market Fund Calculator Kenya Bot

The Money Market Bot will provide the latest money market fund interest rates in Kenya.

It will also clarify if the published daily yield is before deduction of withholding tax (WHT) and management fees.

You can then use this information to calculate money market return using the Money Market Fund Kenya Bot!

The video below is best viewed in full screen mode preferably on a computer. Change from portrait to landscape mode for best viewing experience on mobile/tablet.

Here is Part 1 of a video tutorial on how to calculate the real daily yield of Money Market Funds in Kenya.

Part 2 of the tutorial above also discusses how to adjust the daily money market fund yield for WHT.

Subscribe to the YouTube Channel for more video tutorials.

The Money Market Kenya bot also has the latest Sanlam MMF and CIC MMF forms.

It automates the process to ensure your money market account is created within a day!

You can find more tips including the free Money Market Fund Bot in the Telegram Personal Finance Lessons Channel.

A Gift for reading this far!

You will burst to flames with wisdom my friend! You can really read. So here are exclusive lessons for you!

The video below is best viewed in full screen mode preferably on a computer. Change from portrait to landscape mode for best viewing experience on mobile/tablet.

Read these 3 life changing guides on growing your wealth in Kenya:

- Free Personal Finance Lessons for Kenyans – Learn today

- Rule of 72: Expertly Know When Your Money Doubles in Value

- The Comprehensive Guide on How to Earn Money in Kenya

If you do plan to earn money online, then a PayPal account will be needed.

Join the Tribe!

You can find more tips including the free Money Market Fund Bot in one of the best Kenyan Telegram Channels on Personal Finance.

The Telegram Personal Finance Group is the tribe you have been looking for!

Hope you found this article helpful and got some valuable insights.

You made it to the end of this article.

We are practically best friends now.

Join the clan of over 190 Kenyans in the comment section to ask a question or give feedback 🙂

Sadly people are paying for such content.

Save your friends and family money by sharing this article on your websites and social media apps.

They will benefit from the free content and can use the money saved to start their investment journey.

Help in my mission to spread my financial knowledge for free. Share in your circles

Worth the read. A great elaborate article

Thank you for offering this information and thank God i came across it. I have been looking for a guide on how to go about investing in MMFs for a while now but i did not know how to go about it or the factors to consider. The journey starts today!!

A very educative piece.

I thank God that I have found this.

God bless you.

Thank you for this educative post. I have been looking for this kind of information before getting into MMF business

God bless you for sharing this information.

would you be willing to speak on investments at our church?

It is an insightful content

Thank you! Answered so many of my questions!

Thank you so much for giving me an update on how I will invest my monies this year. You have been my ‘wake up’ call. ☺️ Looking forward to learn more from you.

So, considering every angle, which is the best Money Market Fund overall? Where should I put my money?

The article is very informative and educative. I have learnt a lot and i now understand this MMF better.

Great job.

Do you have a list of management fees charged by MMF

This is actually a gold mine that is also for free. A very good piece this one worth sharing in your circles.

There couldn’t have been any right time to get this info than now, I devote to research more and understand about money markets. I found the article so educative that I shared with my chama members even before I was half way through it. Thank you Mr. Publisher

i would love to know more about MMF

I have learnt alot. I heard about money markets from a friend and my curiosity drove me to this article. I have got more than i hoped for. I look forward to making a wise pick on my preferred fund manager. Thanks a bunch

So informative. I have got all the details I’ve been looking for concerning this investment plan. I’m convinced it’s worth a try

Thank you so much Nash. There is a lot of content online on MMFs but this is the clearest and most comprehensive I’ve seen. One could make a decision right away after this class. I’ve now followed you on Twitter and Subscribed to your YouTube channel. Will also be sharing your stuff with friends. Kudos bro.

What a fantastic article, I need to open up an account that requires little capital because am still a student I would need your directions kindly can we link up via email .

Great work, now i have the idea of what am getting into. Thank you very much.

Warm regards

Thanks for the precise and insightful content.

The article is so informative and well detailed. Kindly continue imparting such knowledge to us. Share some information on investing in government securities and bonds.

Very informative

Thanks so much for your precise article.I am happy and Will join one of the money markets ASAP.

Thanks for this article. I am grateful

I would like to join plz help

Hello,

Find the links to join one of the below (includes step by step guidance and the signed forms)

https://nashthuo.com/sanlam-money-market-fund/

https://nashthuo.com/cic-money-market-fund/

Thank you for taking your time and putting this article together, i have learned a lot and i think am ready to start investing my little income i can see it can do wonders over time.

Thanks for taking the time to leave feedback! Great to hear it was valuable! Let me know if you need help opening your MMF account.

Thank you so much. This was very informative.

Thank you for taking the time to give feedback. Share in your circles and help someone else to learn as well 🙂

This is information I have searched for and found hard to understand in the past, but when I landed on this article, hallelujah!

Thank you for your kind generosity, before I read half of the article I had shared it with several friends.

My kind of people. Thanks for sharing and helping in my mission to educate my fellow countrymen!

Very helpful and detailed.

Exactly what I was looking for.

Thanks for taking the time to give feedback. I am glad it was helpful!

What a great lesson! our schools never include financial literacy and even where there was a unit, it was just given superficially to pass exams. I bumped onto this article after reading about John Boogle who was a teacher but was able to attain financial freedom @30 through low risk investment and proposed Ibonds and Indexing as the best strategies. However, i realized those are based in US and i just googled what would be low risk investments in Kenya and luckily, i landed on this page. I was awed by the information and i couldn’t stop reading and watching the videos. It came at a time i was looking for ways of earning passive income safely and stress-free having tried network marketing and forex trading. I don’t know what to say but it is wow! wow! wow!.

I would follow you to see if there is any info on ibonds and index in Kenya. I believe as i do further research on where to invest, (although you have already convinced me) i will find it from you.

One thing that did not come out clear is whether, or how, if i deposit 500k or 1m and not contribute monthly it will earn me a million in short span or long span. I think also it was not clear if there is possibility of losing the capital by any chance. Although i know you said it is safe and automatic compounding. Thanks a million, i will looking you up and learning more from you as i teach others…..as a community worker trying to fight poverty in our communities! Many many blessings for this!

Thank you very much for taking the time to give comprehensive feedback. Your comment is quite encouraging as I love it when I am able to impact other people’s lives. Yes I intend to write on how to invest in bonds and index funds while in Kenya. So as long as you are subscribed on YouTube and have bookmarked this blog, you should be notified when those are published. Money market funds are low risk investments hence your investment is safe. Once you open your MMF account under my financial advisor code, you will get access to the free automated wealth compounding report that shows you how an investment of 500k or 1m would grow over time with or without monthly deposits.

Thank you, I have learnt something that will help me in life.

Great to hear you found the article valuable. Share with a friend who would also benefit from the knowledge 🙂

great content. Keep up.

Thank you very much for the great feedback!

I found your crash course really well presented. I appreciate it and kudos.

Thank you very much for taking the time to leave the feedback. Let me know if you have any questions

I’m interested in investing my kid’s savings long term with Sanlam or CIC MMF. I just want somewhere safe I can deposit the amount and have it compounded over 10 or more years. What do you think ?

Money market funds are a great option to achieve such a goal. You can get more information on Sanlam and CIC below:

https://nashthuo.com/cic-money-market-fund/

https://nashthuo.com/sanlam-money-market-fund/

wow!, just wow! you have already convinced me bro. This is the information i had been longing for. The journey to financial freedom starts now!

Thank you.

Very educative!

You are welcome Maggie! Glad to hear it was valuable for you!

This has been most helpful for me. Thank you so much. Let me toss between Sanlam and CIC now.

You are welcome. Share in your circles so they can also benefit 🙂

See this step by step guide on how to join Sanlam Money Market Fund (it includes the latest forms and clear instructions on how to fill them)

See this step by step guide on how to join CIC Money Market Fund (it includes the latest forms and clear instructions on how to fill them)

Very informative and detailed

Thank you

Thank you very much Mary! Share the value with your friends, family and colleagues so they also benefit 🙂

I’ve sent an email, kindly check on it and respond. Hoping I’m not late into the MMF party!! My cellphone number is 0713414975

You are not late to the party! I have responded to your email. Will ensure your account is created within a day of receiving the filled forms and required documents! You will also get the automated wealth compounding report once your account is mapped under me 🙂

Heloo Nash how can I join your telegram channel

Here is the link to the Telegram Channel:

https://t.me/personalfinancelessons

Here is the link to the Telegram Group:https://t.me/+VliJ1AeukKnm30jt

Very informative piece

Very informative. Thumbs up!

Very informative

I like this stuff Nash its very informative, i have come across many information but this is excellent and comprehensively elaborated. I would like to start investing with MMF and begin my financial freedom journey.

An inspiring article.

Nice article

Fantastic content! Thank you Nash!!

Whats your take on cytonn who promise a 11%pa returns.?

Thank You for sharing.

Very informative. Great website to have review during quarantine. Please author a book. Got your link through linkedin. Will send to my peers.

Thanks for the incisive guide Nash!

Thank you for the information.

I am currently on the CIC MMF and thus far, it has been good. I was curious about one of your statements and wanted to know why you said it and I quote “….why I would never buy those education policies and investment-linked insurance products.”

It’s something I’ve considered to diversify on passive investments and I wanted to know what insights you have on investment-linked insurance products.

As much as you’re not charging, this info is priceless!

Thanks for the great feedback! Feel free to share the article with your family, friends and colleagues 🙂

Very informative. would wish to know more about this.

Interested.

Thanks for your very well articulated and demonstrated insights. However I think it would be even better for the compounding template to include the 15% witholding tax the government charges on the interest gained, thus clearly show “exactly” how much money one would generally expect. 🙂

HOW ca i get the template @ a fee?

Very informative and in line with my thoughts. Had done almost similar blog sometime back on my social media platform. https://www.facebook.com/langat.cheruyot/posts/10205919556305765, I thing we should team up and create more articles on financial maters.

Thanks Mr.Thou for your comprehensive illustration concerning MMF

You are welcome Kennedy. Feel free to forward the link to the article to family and friends so they can also benefit from the free knowledge 🙂

Hi, after reading your post I went to Sanlam offices in Kisumu and got contradictory information. Apparently the money out in the fund can only be accessed after 3 years according to the agent I spoke with. The features you describe here are ideal for me

The agent definitely misguided you or doesn’t understand the difference between an insurance policy and a money market fund. I personally invest with Sanlam MMF so that’s how I know for sure they misguided you. If you are interested in the Sanlam MMF, you can follow the instructions in my welcome email to you or send me an email to nashthuo@gmail.com

Your article is very informative. At least people can start investing with the little they have. My assumption was that you require a lot of money to start investing in MMF. Thanks, Nash.

You are welcome. You are right that a common thing people get wrong. Share the article and help others learn also

A very enlightening article. Thank you so much for sharing.

Great to hear that Simon! Hope you have shared and enlightened someone else as well 😉

Lovely..have been trying to find out about the same for a while now.

Thank you very much, blessings

You are welcome Pennie. Feel free to share the links with your family and friends so they can also learn 🙂

Thank you Nahashon for these valuable information simple and well elaborated. Im so much interested.

Thank you Daisy! I have added you the mailing list 🙂

Share the link with your family and friends so we can educate as many people as possible.

was good stuff,

Thank you very much Samwel. Share the link with your family and friends so we can educate as many people as possible.

Hi Nash,

Very informative article, you had me on the notes for ‘A’ students. Also refreshing to find someone who shares my love of compound interest, I do my compound interest calculations to 2050’s as well!

Do you have any experience with the Britam Money Market fund? I need some solid advise on whether to invest with them.

Thanks

Esther

You can see my review of all the fund managers returns (including Britam Money Market Fund) here>> https://youtu.be/HLGRNg8M4m0

I did my research and can only recommend CIC (9.32%) and Sanlam (9.87%). Current interest rates are in brackets. If interested download the forms linked in the article above, complete, scan and send them to my email address (nashthuo@gmail.com). I will then facilitate prompt creation of your account 🙂

Would you recommend i investing in gov’t bonds or mutual fund if I have 2m which I need it after five years.

Hi George,

See my article where I highlight the main advantage of Money Market Funds and Unit Trusts in general over direct investment in a government bond>> https://nashthuo.com/faqs-money-market-funds-kenya/#what-is-better-between-investing-in-money-market-funds-mmfs-and-buying-treasury-billsbonds

Great and informative information

Thank you very much

How can I get a copy of the Excel Sheet

I sent it you sir after seeing your comment 🙂

Pewa kdf on my bill. excellent and timely article.add me to your mailing list;sirngure@gmail.com

Hahaha nimepokea bana 🙂

I have added you to the mailing list. You should have received an email from my website.

Kind Regards,

Hi Nahashon,

Thanks for this informative platform. I want to invest 1-1.5M in a mutual fund.Do you think it’s worth it? if the return per month from 1M is 8k, does this really make sense? would you recommend or suggest i invest in gov’t bonds instead. Note it’s my lifetime savings.

Thanks,

Nayomi

I have sent you a personal response to your email 🙂

Can you please assist with the MS Excel sheet for the compound interest calculations

Hi kindly enlighten us on different ways one can generate passive income while still in a very demanding work environment which does not give you time to engage in a side hussle

This is one of my planned future topics 🙂 Ensure you subscribe to the Youtube channel and join the Telegram group so you can be notified when I upload new material

Awsome information here..Thank you ..Been looking for such read for quite smtym.

Thanks for the great feedback. Share it widely so it can help as many people as possible 🙂

Hi nice information and I’m interested joining one of the MMFs.

Thanks for the feedback Maurice!

See this step by step guide on how to join Sanlam Money Market Fund (it includes the latest forms and clear instructions on how to fill them)

See this step by step guide on how to join CIC Money Market Fund (it includes the latest forms and clear instructions on how to fill them)

Hello,

Whats the link to the telegram group?

https://t.me/joinchat/DUzHGhTsUMIOH0MV5t9I7Q

Have been thinking about this for one year. Today you have helped me decide

Happy to hear the article helped you take action coz an year is a lot of time in the world of compounding

how can I get a copy of the compounding excel sheet?

I am working on how I can set it up here so it can help as many people as possible. Watch this space as it should be ready soon 🙂

Thank you so much for this information. I feel totally liberated.. would love to hear your take on fixed calls. Looking forward to engage with you further

Happy to take a call if it helps clear things for you 🙂

thank you Thuo,

This is very insightful and educative not too late to pick up the pieces. looking forward to learn more, have join telegram channel

Very informative and what is the minimum amount one can start with

Thank you very much. Share the link with others and educate them too. Minimum for CIC is 5,000, for Sanlam 2,500

This is well written and informative.

Thank you

Suppose I invest 100,000 with Cic, how much will I earn monthly

Hi Pauline,

You would earn about Ksh 698.09 net of everything per month. The amount earned will increase each month due to the power of compounding. As I said it not a get rich quick scheme.

What’s the minimum cash you can deposit to start with

Hi Ruth,

Sanlam has the lowest minimum initial investment amount of Kes 2,500

CIC minimum initial investment is Kes 5,000

Have a good day and share the knowledge

I concur with you,financial education should be part of 8.4.4,knowledge is key especially when applied.Am in it,so thanks for the insights.

Continue the good work Job of educating others

Thank for this info

Good info here. Looking forward for more.

Will continue in the lessons, I plan to start an investment plan as I am approaching my retirement, I need a way to not see excess money in my account

Hi Jane,

Money Market Funds are excellent for people who are heading to retirement and are already retired. This is because they are low risk investments and most offer capital preservation i.e. You can’t lose the amount invested.

They can also be a good source of passive income and if you have substantial savings, the interest can even cater for your expenses. Finally, as you said they are a great place to park excess funds and have them earn good returns rather than them gathering dust in your account begging to be spent on something you might regret later.

I personally recommend CIC Money Market Fund and Sanlam Money Market Fund. Let me know if you need my help in opening an account with either of them. But I know my website and action plan should have you covered 😉

Have a great day Jane and share the article widely so it can help similar people in your position 🙂

Thanks for being a channel for transformation, I am approaching 50, with a college going son,now, you see we both need help, how can we access you

Thanks for the great feedback! As I always say, If you find the content valuable share the Youtube, Telegram and the website links widely with your friends, family and networks so it can help as many people as possible 🙂

I have added you to the lesson plan (I don’t have your son’s email though). See my email on the same and we can proceed from there 🙂

Thanks Nash, the post is very informative on your next article I would love to see your opinion on Seriani(Cytonn) and ZimeleTrust.

Hi I try to not comment on areas where I don’t have personal experience – and that’s why I can answer any question about SANLAM or CIC without batting an eyelid. However, in the post I have given you the tools to assess your preferred fund manager…if someone is offering higher than the 364 t-bill rate – you have the questions to ask as a skeptical investor – if someone is offering lower than the 91 day t-bill you also have the questions to practice skepticism.

See the specific page of the article that deals with the factors to consider before investing in Money Market Funds in Kenya:

Factors to consider before investing in Money Market Funds in Kenya

See what can happen if things go wrong here:

See what can happen if things go wrong here

Kindly add me to your mailing list kemboi.maiyo@icloud.com

Hello Kipkemboi. You can join my mailing list by clicking the link below:

http://eepurl.com/gBHL2L

You can join my Personal Finance Lessons channel via the link below:

https://t.me/personalfinancelessons

Finally, subscribe to the YouTube Channel for video tutorials.

Thank you for this information. I have been into money market biz since 2014 with CIC, so far so good and Cytonn is also on point

Share the link and the information with your friends and family

Nice …any insight on britam money market fund?

Haven’t analysed them specifically but they did come upin this video

Good job sir.

Question: Seriani and Nabo Africa post very attractive effective annual rates of over 10% yet they are not among your recommended MMFs. Anything we should know?

See my response to Agnes

Thanks so much for the information. I have learnt a lot. I wish we had many Kenyans like you! I look forward to embarking i\on this journey now that I have the knowledge. I have always thought such a venture belongs to the Rich!

God bless you richly.

Hi Irene,

It is a common misconception that only the rich can invest in Money Market Funds in Kenya or that you need a lot of money to start. All which are wrong! Please share the article widely so as many Kenyans can be educated 🙂

Thanks for the blessings and I hope you have now opened a Money Market Fund account

All this info for free? You are God sent Nash..Thanks for today’s lesson

You are welcome Dan. Yes it is free because my aim is to educate and if I charge only very few people will get this life changing information. As I said, I believe personal finance lessons should have been part of our 8-4-4 system

Grateful you taught me how and where to save ) I think i’m on track and may God continue blessing you as you help others.

Thanks Jane and thanks for the blessings

This is very informative. Thanks for this. Some of us have this money markets funds accounts but dont know the details about how it operates…its indeed an eye opener

True Mercy. There are people who have invested in Money Market Funds in Kenya because a friend recommended them. However, by the end of these lessons it will be clear how they they work and how they can use them to grow their wealth

With every post I read, does another light bulb go on. As you rightly put it; with money – hindsight is a powerful tool

It is a powerful tool – the trick is to learn from hindsight where need be, so as to make better decisions going forward. And to also share the knowledge and lessons with others so as to help make the world a better place 🙂

Thank you for sensitizing the masses

Thank you Nash for sharing this publicly. I can’t tell you how much i needed this kind of information. I know i speak for several other people when i say that i thought that the money market was for people with loads of money. May your kindness be repaid by the Almighty 🙂

Thanks for the great feedback Angi. It encourages me to continue with the lessons. It also encourages those who may think that Money Market Funds in Kenya are reserved for the rich and powerful. Continue sharing so we can help as many people as possible 🙂

Haha Goodstuff Nash naona hatutapumua na hizi ‘Nash Said So’!!

Great job Nahashon.

Thanks Jackie

Nice article.Thanks for sharing.

Thanks Susan for your kind comment 🙂

Hi,

This is a very good learning platform. Thanks for sharing. Have you done any due diligence on Sanlam. Do you mind sharing?

Hi Maureen,

A lot of people have asked about Sanlam and so in my next post I will go into the detail of why I invest my money with them and what factors one should consider before committing to a Money Market Fund in Kenya. In the meantime, in the video below I have mentioned the 3 reasons I prefer Sanlam to everyone else:

https://www.youtube.com/watch?v=SpPgNhZBslY

Maureen, remember to share the article with your friends and networks so it can help as many people as possible 🙂

Hi,why do you prefer Sanlam over the other providers?

I will cover it in detail as a post but in the meantime I had answered your question in the below video

https://www.youtube.com/watch?v=SpPgNhZBslY

Thanks Nahashon!

This is very informative and an eye opener!

Thank you for the detailed report. Very informative.

You can now post a comment as I just did 🙂

This is fantastic, are you still operating your MMF or things have changed, i note the posts are of 2019.

Very detailed and informative. Thanks for sharing these keys to financial freedom

Excellent! Great to hear it was valuable information. All the best in your journey to financial freedom!

It’s my first time following you after reaching on how MMfs work, am convinced by your article and youtube take through, ill be glad to be on your mailing list.

Asante sana

Glad to hear the content was valuable to you! Welcome to the mailing list. Hoping to share more insights soon 🙂